Print PDF

Green Slip scheme quarterly insights - December 2018

You can download a PDF of the CTP Green slips quarterly insights

Executive Director’s message

On 1 December we reached a milestone, the first anniversary of the 2017 CTP scheme. I would like to extend my thanks to all our stakeholders and interested parties who provided advice and input into the scheme’s design and continue to do so.

Over 50 per cent of people are receiving benefit payments within the first three months after a claim. Twice as many as under the previous scheme.

The pre-reform average premium target price (all vehicles) of $528 was met on 1 December 2017, and 12 months later has been further reduced to $523. Our actuarial advice is that, without reform, average CTP premiums may have exceeded $652 by 2018.

CTP Assist, our multi-channel personalised claims support and information service, has been well received by our customers. See our Net Promotor Score on page ten: it measures how likely a customer is to recommend CTP Assist to others.

Our Green Slip Check has also been further improved. In June, we added the ability to click directly from the Green Slip Check to buying a Green Slip from three insurers. From November, all insurers have the ‘buy now’ option, saving vehicle owners time and effort in finding the best price and paying their premium.

As the scheme’s regulator, it’s our responsibility to identify any practices that could compromise the scheme or its ability to deliver for people who have been injured in a motor accident. We are continually monitoring insurer behaviour and compliance with the legislation and will continue to refine our strategic approach to supervision.

As we enter the second year of the scheme’s development, we will maintain our strong focus on regulatory oversight, injury prevention and improving the customer’s experience of the CTP Scheme.

Feedback on how we can improve this report is appreciated and can be sent to: [email protected].

Mary Maini

Executive Director

Motor Accidents Insurance Regulation SIRA

The scheme to date

Some key figures for the 2017 CTP scheme for its first thirteen months: 1 December 2017 to 31 December 2018.

- Over 5.9 million policies sold

- Over 3.5 million Green Slip checks

- 11,794 claims lodged

- 96,402 interactions with CTP Assist

- Average premium $523 - 17.6 per cent down (NSW average premium all vehicles December 2018 vs pre-reform)

- Claim related payments $85 million

- Over $209 million refunded.

2017 CTP scheme turns one

SIRA is actively monitoring and reporting on the scheme. One year on and the 2017 CTP scheme has maintained reduced premiums, better supports people in their recovery and has significantly improved digital and online service delivery. Here are some key first year achievements:

- SIRA is supporting people to get on with their lives. Our CTP Assist team supports people to ensure they have the best possible claims and customer experience. We are continually implementing ways to enhance customer experience.

- The reform target average premium price for all vehicles of $528 was met on 1 December 2017. This premium price has been further reduced since the scheme commenced and the actual premium at December 2018 was $523.

- The launch of our online claim submissions and notifications system enables people to digitally complete and lodge a claim.

- People injured in motor accidents receive early access to income support, treatment and care. Twice as many people are receiving benefits within three months of their claim than under the previous scheme.

- SIRA launched ‘Green Slip Check’, an online tool that allows vehicle owners to get a Green Slip quote comparison from all insurers (for vehicles up to 4.5 tonnes). Later in 2018 the Green Slip Check was digitally integrated with Roads and Maritime Services to enable the ‘buy now’ function for vehicle owners purchasing a Green Slip. This facilitates a seamless transaction from selecting the best price to purchasing the policy.

- Over 3.5 million green slip price checks have been undertaken.

- 50,000 responses were received on the Green Slip Price Check. Around 93 per cent rated it positively.

Information that’s accessible to all

Our third animated explanatory video is now live on the SIRA website and YouTube channel.

This new video tells us the story of Eric who has been injured in a bus accident. The video shows how people like Eric, who have been injured on NSW roads, are supported through their claim and recovery by SIRA's CTP Assist.

CTP Assist can help Eric with various information and support services such as:

- Helping him find out which insurer to claim with and helping him to submit a claim online

- Contacting him regularly to ensure his recovery is on track, and that he has all the information he needs

- Referring him to the Injury Advice Centre on SIRA’s website, which provides recovery information that complements his doctor’s advice and treatment

- Providing information on legal services or community services that are available.

Like all our animations, information is presented clearly and concisely to assist people to understand the way in which the scheme operates, and the services provided by CTP Assist.

Watch it on SIRA’s website or YouTube channel.

Awareness of the 2017 scheme

SIRA has been actively raising awareness of the scheme to a range of audiences to ensure key parties are focused on health recovery outcomes. Here’s an overview:

- Doctors have received information on scheme benefits, CTP Assist and how to claim. These materials have been loaded onto general practitioner software and sent to over 145 hospitals across NSW.

- Hospital staff across 12 local health districts and three specialty networks have participated in education sessions.

- ‘A guide for people injured in motor accidents in NSW’ was developed by SIRA, with NSW Health, to increase awareness among injured people and assist them to make and manage a CTP claim. The Guide is distributed by NSW hospital staff and is also available on the SIRA website. Over 70,000 copies of the Guide have been sent out to the NSW community.

- Nearly 40,000 wallet cards were sent out to the NSW community, with information on the 2017 scheme and CTP Assist. These are also published on the SIRA website.

- CTP Green Slip posts on the SIRA Facebook page reached more than 600,000 people by the end of December 2018 with 16,700 post clicks and 1,800 likes/reactions.

- Three animations: How to claim, Benefits available and The CTP Assist service were launched on Facebook and YouTube with almost 100,000 views.

- Information about the 2017 scheme was provided to motorists by insurers with CTP renewals.

- Medical and allied health journals, with over 180,000 readers, were provided with material about the scheme.

- There were more than 40,000 visitors since 1 December 2017 to the CTP claims landing page and more than 37,000 visitors to the web page about claiming personal injury benefits.

- SIRA presented at the Legalwise Seminar in November 2018. ‘View from the regulator’ was the topic which provided a 12-month retrospective on the scheme.

- CTP Assist, our people support service, answers telephone and digital inquiries from people in both the 1999 scheme and 2017 scheme; providing advice and connecting them with an insurer.

- SIRA’s Legal Advisory Service pilot, provides legal advice relating to statutory benefits claims where legal fees are restricted by the Motor Accident Injuries Act 2017 (2017 Act) and supporting regulations.

- To use this service a person can simply call CTP Assist who will help arrange a referral if they are eligible.

Green Slip refunds

By 31 December 2018, 79 per cent of policy holders (vehicle owners, businesses and taxis) had made refund claims.

Around $209 million had been returned to over three million policy holders this quarter.

Refunds can be claimed through Service NSW online, by phone – on 1300 287 733 from 7am-7pm Monday to Friday or outside those hours on 13 77 88 - or visit any of its service centres and Council Agencies around the state.

Buy now added to Green Slip Check

Green Slip check now lets you click straight through to buy a Green Slip from any one of our CTP insurers.

Green Slip Check is a fast, user friendly price comparison tool which helps motorists get the best Green Slip deal. Over 3.5 million checks have been made since it started in November 2017.

Click-through to buy

From November we have added the ability to click straight through to any one of our CTP insurers. Use of the ‘buy now’ option has steadily increased each month with about 39 per cent of people taking up this option in December 2018.

‘Buy now’ provides valuable customer usage data to help us improve our services for motorists and support our regulatory role with insurers. Data collected tells us how the tool is being used by different areas of NSW and which insurers are selected. It also increases our data on insurer market share, helps us monitor Green Slip premium prices filed with SIRA by insurers and indicates the numbers of people changing insurers for a better deal.

www.greenslips.nsw.gov.au/price-check

CTP Assist: help for injured people and their families

CTP Assist provides personalised claims support and information by phone, post, email or chat for people who have been injured, policy holders and others in the CTP scheme such as doctors and health professionals.

Our support officers make regular contact with people after they have lodged a claim, to ensure they receive needed support. The same support officer calls each time to maintain a strong connection.

For anyone who needs CTP help: 1300 656 919 (8:30 am to 5 pm, Monday to Friday) email [email protected] or enquire online at www.sira.nsw.gov.au

Case studies

Here are some examples of people recently helped by the service (names and personal details have been changed for privacy):

Urgent care provided the Friday before a long-weekend

Patrick’s 15-year-old son was significantly injured in a car crash and had spent a large amount of time away from high school.

As well as his physical injuries, the crash had badly affected his son’s psychological well-being. He had become detached from friends and was threatening self-harm. Deeply concerned, Patrick wanted approval from the insurer to place his son in a health care clinic immediately.

Patrick contacted CTP Assist and spoke to Ethan who offered to contact the insurer on Patrick’s behalf, as he was a shift-worker and only available at certain times during the day.

Ethan quickly reached out to the insurer and explained Patrick’s concerns. The insurer then contacted Patrick the same day to advise that his son’s much-needed care had been approved.

Patrick was extremely grateful advising that Ethan’s urgent help had allowed him to focus on his work, safe with the knowledge that his son was being looked after.

The power of caring

At her 23-week call, Tania told Kelly of CTP Assist that she was doing well. Her insurer was covering the costs of her physiotherapy, specialist appointments, scans, prescriptions and other care expenses.

Kelly also received from the insurer a series of sessions with a psychologist to help her become comfortable driving next to trucks, something she’d been terrified of since her accident.

The sessions had worked well for her, helping her overcome her fear and allowing her to go back to work.

Talking to Kelly, Tania highlighted one simple thing her insurer’s case manager had done which made a big difference. They’d been communicating by email, as Tania’s work made phone contact difficult, and her insurer case manager had commenced an email with the words ‘How are you?’.

“Before this, our communication was mainly to do with numbers and treatment requests, so to be asked a simple “how are you?” made me feel supported and was very important to me” said Tania.

Empathy and support

A driver who was on his mobile lost concentration and crashed into Parisa’s car. She suffered psychological injuries from the accident and lost confidence in day to day living.

While her family were supportive, Parisa was very distressed, even tearful at times, when Helen from CTP Assist made regular contact.

Helen provided empathy and supported Parisa, suggesting activities for her to take her mind off the accident and get back to her pre-accident life. Helen also recommended Parisa seek approval for psychological treatment from the insurer.

The insurer approved the treatment, and Parisa praised the insurer’s case manager for the support they had provided her.

Kindness during a time of grief

Mai’s uncle passed away in a motor vehicle accident. After Mai lodged a claim, Laila from CTP Assist contacted her offering support and advice. The claims process had run smoothly with the insurer paying the funeral expenses without hesitation.

After the funeral, Laila received a compliment from Mai thanking her for her “kindness and compassion” during her time of grief. Laila continues to regularly check-in with Mai to ensure her well-being.

CTP Legal Advisory Service

A CTP Legal Advisory Service pilot was launched by SIRA in mid-December 2017. The service provides legal advice relating to statutory benefits claims, where legal fees are restricted by the 2017 Act and supporting regulations. It is a phone-based service where people are referred to a panel solicitor.

There have been nine referrals to the Legal Advisory Service since it commenced, including two referrals during this quarter.

SIRA will commence evaluating the pilot in the first quarter of 2019.

Using the legal advisory service

To use this service a person can call CTP Assist and a support officer will help arrange a referral if they are eligible. Advice is personal and confidential. There is no charge.

Two examples of people recently helped by the service follow (names have been changed for privacy):

Case 1

Dinesh has recently transitioned from full-time employment to being a director of his own business. He believed the insurer was underpaying him and contacted CTP Assist for advice following an insurer internal review.

Due to a complicated work history, Dinesh believed the insurer had calculated his weekly benefits incorrectly.

CTP Assist referred Dinesh to the Legal Advisory Service where he received phone-based legal advice from a panel solicitor. Based on the legal advice he had received, Dinesh decided to escalate the matter to SIRA’s Dispute Resolution Service where a decision was made in his favour.

Case 2

Cindy is self-employed and her business had recently undergone a restructure. She called CTP Assist for advice about her weekly benefit payments following an insurer internal review.

CTP Assist referred Cindy to the Legal Advisory Service. Following phone-based advice from a Legal Advisory Service panel solicitor, Cindy decided to escalate the matter to SIRA’s Dispute Resolution Service where a decision was made in her favour.

Measuring customer satisfaction

To measure and improve customer satisfaction with CTP Assist, SIRA has adopted two widely used service quality ratings: Net Promoter Score (NPS) and Customer Effort Score (CES). Together, these let us continuously measure the overall quality of the service and identify opportunities for improvement.

NPS measures how likely a customer is to recommend CTP Assist to others. CTP Assist has continued to achieve another excellent NPS result, with the rolling average for December sitting at +44. Although this is slightly lower than the rolling average for 2018, it remains at an excellent level. Since April 2018 the rolling average has been +46 or above making it a national leader in delivering a great customer experience according to the Australian NPS Pulse Check.

CES measures how easy it is for a customer to get the help they need. The CES score remained at an excellent level of 4.1 out of 5, suggesting that the customers believed CTP Assist made it easy to get help.

Key statistics 2017 scheme

This section provides 2017 scheme statistics for the December quarter, and/or from the scheme’s start on 1 December 2017 to the quarter end.

| Injury category | To date |

|---|---|

| Assessed minor injury | 4,042 |

| Indicative minor injury | 1,175 |

| Assessed non-minor injury | 2,726 |

| Indicative non-minor injury | 658 |

| Not yet known | 2,070 |

| Total | 10,671 |

| Claim type | Qtr | To date |

|---|---|---|

|

At fault Not at fault Fault not determined |

477 2,214 155 |

1,425 6,039 3,207 |

| Total | 2,846 | 10,671 |

| Early notifications | 162 | 605 |

| Interstate claims | 108 | 288 |

| Workers compensation | 10 | 31 |

| Compensation to relatives | 63 | 199 |

| Earning status | To date | Percentage |

|---|---|---|

| Earners | 5,851 | 55% |

| Non-earners | 2,452 | 23% |

| Not stated | 2,368 | 22% |

| Total | 10,671 | 100% |

| Insurer | Number of claims | Percentage of total |

|---|---|---|

| AAMI | 141 | 7.9% |

| Allianz | 202 | 11.3% |

| CIC Allianz | 119 | 6.7% |

| GIO | 278 | 15.6% |

| NRMA | 652 | 36.5% |

| QBE | 396 | 22.1% |

| Total | 1,788 | 100%1 |

Note 1: Rounding

| Payment type | Amount |

|---|---|

| Weekly payments | 39,686,782 |

| Treatment expenses | 38,315,195 |

| Care | 814,128 |

| Funeral expenses | 1,803,703 |

| Insurer investigation | 4,194,448 |

| Insurer medico-legal | 112,752 |

| Insurer legal | 93,782 |

| Damages | 0 |

| Claimant legal | 44,581 |

| Recoveries | -101,222 |

| Total | $84,964,1512 |

Note 2: Larger than sum of items due to rounding

Fatalities

| Number of fatalities on NSW roads | QTr |

|---|---|

| Fatalities | 783 |

Note 3: Centre for Road Safety, Transport for NSW

Legal representation

| Representation | To date |

|---|---|

| Legally represented | 2,528 |

| Self represented | 8,143 |

Dispute resolution

| Dispute review type | Qtr | To date |

|---|---|---|

| Insurer internal review | 671 | 1,466 |

| Dispute Resolution Service | 406 | 756 |

Note: For a more detailed breakdown of dispute resolution refer to the statistics "insurer internal review" and 'Disputes and litigation' on pages 14 and 15.

| Late claims | To date |

|---|---|

| Number of late claims refused | 117 (from 440 claims classified as not eligible for benefits for the first 26 weeks) |

Scheme insurers

The Green Slip market is privately underwritten4 by six licensed insurers operated by four organisations: Suncorp (AAMI and GIO), Allianz Australia (Allianz and CIC Allianz), NRMA and QBE.

Note 4: Underwriting is the process of assessing risk and ensuring the cost and conditions of the cover take into account the risks faced by the individual concerned.

Best prices by insurer

The best price is defined as the lowest CTP premium price (including levies and GST) offered by each insurer to a new customer, aged 30 to 54, for a private use passenger vehicle garaged in Sydney. It is based on the premium filing5, lodged with SIRA, that is effective during that quarter.

[Note 5: A filing shows proof of financial responsibility in setting premiums.]

Below is a comparison of Sydney best prices for passenger motor vehicles at the end of the December 2018 quarter, compared to prices at the end of the previous (September) quarter.

| Insurer | September 2018 quarter | December 2018 quarter | Best practice change |

|---|---|---|---|

| NRMA | $468 | $468 | $0 |

| GIO | $471 | $457 | -$14 (-3.0%) |

| AAMI | $475 | $459 | -$16 (-3.4%) |

| Allianz | $478 | $478 | $0 |

| QBE | $470 | $470 | $0 |

| CIC Allianz | $467 | $467 | $0 |

Premiums – best price changes during the quarter

From 1 December 2018, Suncorp (AAMI and GIO) implemented reduced prices. During the quarter, AAMI’s best price reduced from $475 to $459 and GIO’s from $471 to $457 as shown in the above table.

While CIC Allianz will cease issuing CTP policies from 15 January 2019, its policy renewals will be managed by Allianz. During the quarter, Allianz submitted a filing based on the consolidated Allianz and CIC Allianz licenses, to be effective from 15 January 2019. Allianz’s best price will reduce from $478 to $454, a $24 reduction. This price reduction includes the SIRA approved reduction in levy rates from 15 January 2019 which reduces the price of all insurer premiums by $13.

Premiums collected

The table below compares the total premiums collected6 during the September 2018 and December 2018 quarters. The total premiums collected fell by 7.0 per cent during the December 2018 quarter.

Note 6: The total premiums collected, market share and average premium are sourced from insurer Quarterly Premium Returns.

| Insurer | Sep 18 quarter | Dec 18 quarter | Premium change ($) | Premium change (%) |

|---|---|---|---|---|

| NRMA | $164,296,112 | $152,256,573 | -$12,039,539 | -7.3% |

| GIO | $86,212,839 | $85,410,821 | -$802,018 | -0.9% |

| AAMI | $39,377,976 | $36,126,473 | -$3,251,503 | -8.3% |

| Allianz | $64,650,872 | $63,840,469 | -$810,403 | -1.3% |

| QBE | $140,057,018 | $120,674,733 | -$19,382,285 | -13.8% |

| CIC Allianz | $37,625,124 | $36,601,013 | -$1,024,111 | -2.7% |

| Total | $532,219,941 | $494,910,082 | -$37,309,859 | -7.0% |

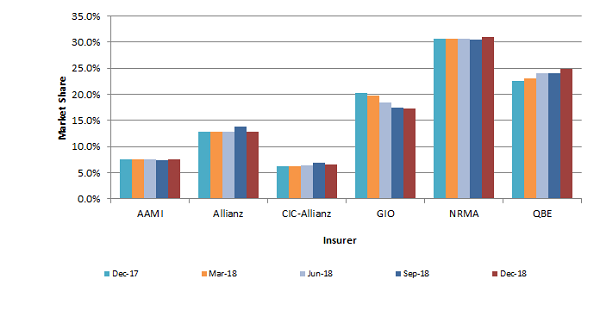

Market share

Under the 2017 Act, insurers must provide SIRA with the amount of premiums collected from policies issued each quarter. This is called a Quarterly Premium Return. SIRA is then required to inform insurers of their proportion of market share.

The graph ‘Premium market share (rolling 12-month) comparison7 shows the proportion of annual premiums collected by insurers from the December 2017 quarter (including the 1999 scheme) to the December 2018 quarter. It is based on a rolling 12-month period to smooth trends in market share by compensating for seasonal renewals of large fleets of vehicles.

During the December quarter, NRMA retained the largest market share with 30.8 per cent, followed by QBE with 24.4 per cent, GIO with 17.3 per cent, Allianz with 12.9 per cent, AAMI with 7.3 per cent and CIC-Allianz with 7.4 per cent.

Since December 2017, QBE gained 1.4 per cent, NRMA 0.1 per cent, CIC Allianz 0.3 per cent and AAMI 0.1 per cent market share respectively. GIO lost 2.0 per cent market share while Allianz’s market share remained unchanged.

Note 7: The total premiums collected, market share and average premium are sourced from insurer Quarterly Premium Returns.

Note: Graph is based on premiums paid by motorists without adjustment for any refunds because of the new scheme. Independent analysis showed the impact of including the refunds was minimal on each insurer’s market share. All insurers agreed with this approach.

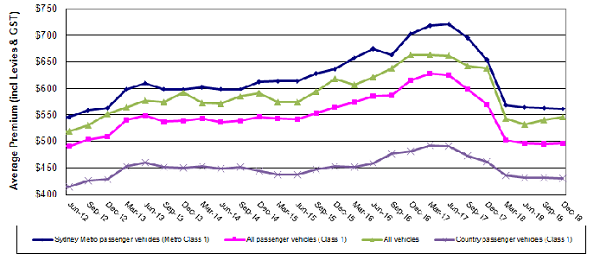

Quarterly premium trends

The graph below shows that Green Slip premiums for all passenger vehicles have fallen since the 2017 scheme commenced and are staying at levels like those in 2012.

The average Green Slip premium8 paid by all NSW passenger vehicle owners at December 2018 was $497, a $73 (13 per cent) reduction compared with the December 2017 quarter price of $570.

The ‘all vehicles’ quarterly average premium at December 2018 was $546, a $93 (15 per cent) reduction compared to the December 2017 quarter price of $639.

Note 8: The total premiums collected, market share and average premium are sourced from insurer Quarterly Premium Returns.

Insurer supervision

To further support our regulatory oversight, SIRA introduced the Motor Accident Injuries Act 2017 Self-Assessment Tool.

The self-assessment tool gives insurers an opportunity to assess themselves against compliance requirements. Improvement plans must then be established by insurers to continuously improve their practices.

SIRA will conduct a random review of the insurer improvement plan following their use of the tool.

Insurer internal reviews

If a person disagrees with the insurer’s decision, they will usually need to request an insurer internal review. The internal review will be conducted by a person with the required skills, experience, knowledge and training, who did not have a role in the original decision. This allows the person and insurer to resolve the disagreement quickly and easily.

If a person is not satisfied with the outcome, they can lodge a dispute with SIRA’s Dispute Resolution Service (DRS). An insurer internal review is needed before most disputes can be lodged with DRS.

In the December quarter 671 insurer internal reviews were lodged.

| Internal review type | Number | Percentage |

|---|---|---|

| Is the injury more than a minor injury? | 751 | 51.2% |

| Amount of weekly benefit payments | 111 | 7.6% |

| Is treatment and care reasonable and necessary? | 227 | 15.5% |

| Is the injured person mostly at fault? | 121 | 8.3% |

| Statutory benefits claim time limits | 38 | 2.6% |

| Was accident the fault of another? | 36 | 2.5% |

| Other | 182 | 12.4% |

| Total | 1,466 | 1009 |

Note 9: Rounding

| Internal review outcome | Number | Percentage |

|---|---|---|

| Decision upheld | 858 | 58.5% |

| Decision overturned | 261 | 17.8% |

| Withdrawn | 88 | 6% |

| Declined | 115 | 7.8% |

| In progress | 144 | 9.8% |

| Total | 1,466 | 100%10 |

Note 10: Rounding

Disputes and litigation

Where a person disagrees with an insurer’s decision after an internal review, they can access SIRA’s Dispute Resolution Service (DRS). Note: some matters can proceed directly to DRS.

Disputes

Disputes are distinct from complaints. Disputes are about a difference of opinion on a decision while a complaint concerns dissatisfaction with a service, or disapproval of conduct or practices. Complaints can be about CTP policies, insurer practices, services or conduct.

In the quarter ended 31 December 2018, 406 disputes were lodged under the 2017 scheme, bringing the total to 756.

Litigation

There have been no litigated claims under the scheme to date. There was one litigated claim recorded in the September 2018 Green Slip scheme quarterly insights report, however, this has been confirmed as an entry error.

| Type | Dispute matter | Decision overturned | Decision upheld | Settled | In progress | Declined | Withdrawn | Total |

|---|---|---|---|---|---|---|---|---|

| Medical | Minor injury | 42 | 113 | 1 | 311 | 14 | 7 | 488 |

| Medical | Is treatment and care related to injury caused by accident? | 1 | 8 | 1 | 8 | 5 | 1 | 24 |

| Medical | Is treatment and care reasonable and necessary? | 3 | 13 | 0 | 35 | 2 | 0 | 53 |

| Miscellaneous claim | Is the injured person mostly at fault? | 9 | 7 | 3 | 30 | 2 | 0 | 51 |

| Miscellaneous claim | Was the accident the fault of another? | 6 | 1 | 0 | 4 | 0 | 0 | 11 |

| Miscellaneous claim | Statutory benefit claim time limits | 3 | 5 | 2 | 4 | 0 | 0 | 14 |

| Merit review | Amount of weekly benefit payments | 14 | 7 | 0 | 4 | 2 | 0 | 27 |

| Invalid dispute | Invalid dispute | 0 | 0 | 0 | 0 | 5 | 0 | 5 |

| Other | Other* | 11 | 11 | 1 | 48 | 11 | 1 | 83 |

| Total | 89 | 165 | 8 | 444 | 41 | 9 | 756 |

*’Other’ includes a range of dispute types with low numbers e.g. exclusion from statutory benefits when person commits a serious driving offence.

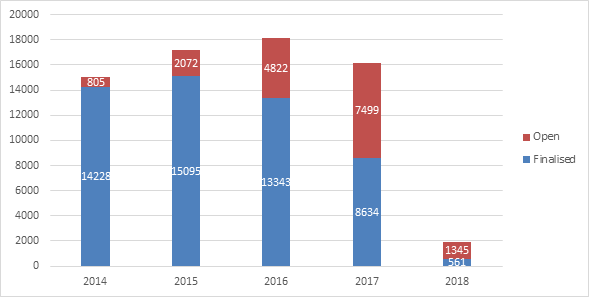

Key statistics 1999 scheme

The last policies for the 1999 scheme, which operates under the Motor Accidents Compensation Act 1999, were sold on 30 November 2017.

As people injured up to 30 November 2017 have up to six months after their accident to submit a claim, regular lodgement of claims ended on 31 May 2018. Claims may be lodged late either with the consent of an insurer or by order of a court.

Any disputes that may arise in claims in the months and years ahead may still be referred to the Medical Assessment Service (MAS) and the Claims Assessment and Resolution Service (CARS), operated by SIRA’s Dispute Resolution Service (DRS).

SIRA monitors the 1999 scheme, allocating resources for insurer supervision activities to continue to ensure insurers are delivering a positive customer experience.

This scheme will be in operation for many years, as people’s injuries, claims and any disputes which may arise, are resolved.

- One hundred and thirty-one (131) new claims were lodged in the quarter, including:

- One not-at-fault Accident Notification Form (ANF)

- Two at-fault ANF

- One hundred and twenty-five (125) full claims directly reported

- Three full claims converted from an ANF.

Open or active claims

As of 31 December 2018, there were 19,302 open claims under the 1999 Scheme. This compares with 21,869 as at 30 September 2018.

The time to settle a claim under the 1999 scheme may be affected by the time it takes for an injury to stabilise, enabling the parties to assess whether there may be an entitlement to damages for non-economic loss, and to resolve any disputes. It is not uncommon for claims to take three to five years to be resolved.

- Total gross paid – $380 million for the December quarter.

- Outstanding estimate by insurers as at 31 December 2018 – $3.96 billion.

| Insurer | Number of claims | Percentage of total |

|---|---|---|

| AAMI | 13 | 9.9% |

| Allianz | 6 | 4.6% |

| CIC Allianz | 8 | 6.1% |

| GIO | 28 | 21.4% |

| NRMA | 36 | 27.5% |

| QBE | 39 | 29.8% |

| Zurich* | 1 | 0.8% |

| Total | 131 | 10011 |

Note: Zurich stopped issuing Green slip policies to the public under the 1999 scheme on 1 March 2016.

Note 11: Rounding

| Total new claims | Self-represented | Legally represented |

|---|---|---|

| 131 | 49 | 82 |

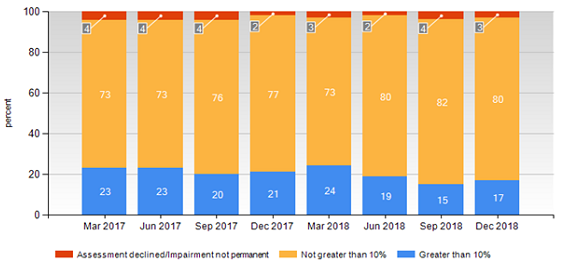

Medical Assessment Service (1999 scheme)

SIRA’s Dispute Resolution Service delivers the Motor Accidents Medical Assessment Service (MAS), as part of the 1999 scheme, to resolve any medical disputes between people injured and insurers.

Medical disputes are referred to independent expert decision-makers (MAS Medical Assessors) for determination.

Medical assessments, particularly about permanent impairment, are usually referred to MAS about two and a half years after a motor accident, once injuries have stabilised. We therefore expect to see the volume of disputes continuing at the current rate until about mid-2020, for accidents occurring before the new scheme started on 1 December 2017.

| Subject of dispute | Number |

|---|---|

| Permanent impairment | 912 |

| Treatment and care | 135 |

| Further medical assessment | 106 |

| Medical assessment review | 253 |

| Total for quarter ended 31 December 2018 | 1,406 |

| Total for previous quarter | 1,502 |

Disputes resolved by MAS

There were 1,433 disputes resolved by MAS this quarter, compared with 1,261 in the previous quarter.

The predominant medical disputes determined by independent MAS Medical Assessors are disputes about permanent impairment, to help parties determine whether a person is entitled to claim damages for non-economic loss.

People who have been assessed with permanent impairment of greater than 10 per cent may claim for damages.

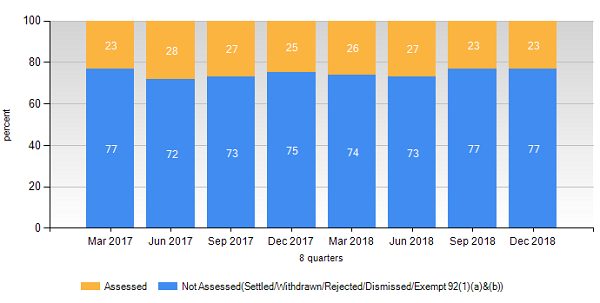

Nearly 1,000 permanent impairment disputes were resolved in the December quarter. As the graph below shows, 17 per cent of these were assessed as having a permanent impairment greater than 10 per cent, a lower proportion than most prior periods.

Claims Assessment and Resolution Service (1999 scheme)

The Dispute Resolution Service also delivers the Motor Accidents Claims Assessment and Resolution Service (CARS), as part of the 1999 scheme, to resolve any claims disputes between people injured in motor accidents and insurers.

Disputes about claims are referred to independent expert decision-makers (CARS Claims Assessors), led by the Principal Claims Assessor.

Claims assessments are usually referred to CARS about three years after a motor vehicle accident, once injuries have stabilised and any damages can be assessed and potentially negotiated by the parties. We therefore expect to see the volume of claims assessments referred to CARS continuing at the current rate until about 2020, three years after the new scheme commenced.

| Subject of dispute | Number |

|---|---|

| General claims assessment | 589 |

| Further general claims assessment | 1 |

| Special assessments of procedural disputes | 34 |

| Applications for exemption from claims assessment | 326 |

| Total for quarter ended 31 December 2018 | 950 |

| Total for previous quarter | 1,026 |

Disputes resolved by CARS

This quarter 832 disputes were resolved by CARS, compared with 851 disputes resolved in the previous quarter.

General assessments of claims are the predominant dispute referred to CARS. These may include assessments of liability, damages and legal costs. Over 400 general assessment disputes were resolved in the December quarter, most without the need for a decision by a CARS Claims Assessor. This rate is consistent with prior periods.

Administrative law challenges to decisions (1999 scheme)

Decisions made by statutory administrative decision-makers, including Merit Reviewers, Medical Assessors and Claims Assessors, are all potentially subject to administrative law judicial review in the NSW Supreme Court.

During this quarter, 2,265 disputes were resolved by the Medical Assessment Service (MAS) and the Claims Assessment and Resolution Service (CARS).

Administrative challenges this quarter included the following for each of these services:

CARS

- Six challenges to CARS decisions were commenced on behalf of an insurer.

- Two challenges to CARS decisions were determined by the court, one each in favour of an insurer and an injured person.

- Nine challenges to CARS decisions are currently before the courts.

MAS

- Nine challenges to MAS decisions were commenced, five on behalf of an injured person and four on behalf of an insurer.

- Six challenges to MAS decisions were finalised by the courts, four in favour of an insurer and one in favour of an injured person (one matter was agreed between the parties to be discontinued).

- Twenty-three challenges to MAS decisions are currently before the courts.

DRS and court decisions are now online

SIRA’s Dispute Resolution Service (DRS) is an accessible service that provides prompt, impartial resolution of disputes between people injured and insurers.

To help improve decision making, ensure the process is transparent and help avoid unnecessary disputes, DRS merit review and claims assessment decisions are now being published on the SIRA website, as provided for in the 2017 Act.

Case studies on minor injuries explore a variety of situations and decisions on this aspect of the 2017 scheme.

Court decisions on administrative law challenges to DRS decisions under the 1999 scheme are also published.

Keeping the scheme sustainable

Fraudulent claims, including those with staged accidents, exaggerated injuries and collusion, are a burden for motor accident insurance schemes around the world.

The cost of this is carried by the whole community in the premium prices we pay for third party insurance. This is why reducing fraud benefits everyone.

Powers under the 2017 Act have strengthened SIRA’s ability to investigate and prosecute people attempting to cheat the system.

Police update

We work closely with the NSW Police Force’s Financial Crimes Squad to deter, detect and prosecute fraudulent claims.

There were no charges or arrests by Strike Force Mercury this quarter.

Feedback, compliments and complaints

SIRA welcomes customer feedback and provides a broad range of feedback channels to encourage as many people as possible to engage with us. Such channels include: by phone, email, post, through our website, or through the Feedback Assist widget on our website and Green Slip Check.

Policy holders, people injured in a motor accident and other members of our NSW community offer complaints, compliments and suggestions.

The different perspectives received enable us to improve the services we, and the insurers we regulate, deliver.

Compliments

Case study

Here is an example of an escalated complaint from the Minister’s Office, referred for resolution (names and personal details have been changed for privacy).

The power of listening to customers

David was unhappy. He had contacted the insurer for help, but was not satisfied with their communication, the support from his case manager, and a delay in processing his claim.

Needing help to register his complaint, David contacted the Minister’s Office who put him in touch with SIRA. A senior complaints advisor listened to David’s concerns and talked him through the options and steps for resolving his complaint.

This gave David a better understanding of what his insurer should be doing to manage his claim, and the type of assistance he needed to support recovery. David was pleased by the way that SIRA communicated with him, understood and resolved his concerns, and gave him the confidence to complain about the insurer.

To make sure David was satisfied with the service, SIRA’s Customer Experience team offered David the opportunity to complete a customer experience survey. Overall, David was extremely satisfied with the complaints resolution service provided, giving a 10 out of 10 satisfaction rating.

Compliments this quarter

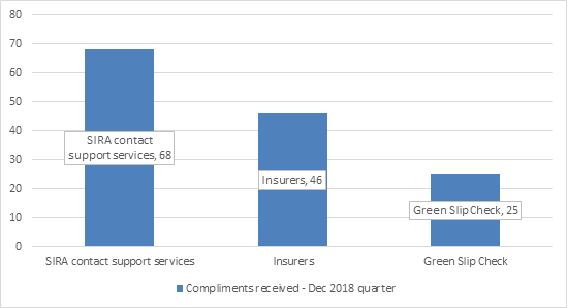

In the December quarter, a total of 139 compliments were received by SIRA. Of these, 68 praised our contact support services, 46 praised an insurer, and 25 praised our CTP Green Slip Check.

Centralised complaint handling

SIRA’s centralised complaints handling function, that commenced in June 2018, improves the tracking, monitoring and resolution of complaints.

Most complaints are straightforward and are resolved by our CTP Assist team (simple complaint). Complaints that need more time or are about more complex matters are resolved by our Senior Complaints Advisory team (complex complaints). Complex complaints include complaints escalated at the customer’s request.

Customers who are dissatisfied with SIRA’s complaint handling can contact the NSW Ombudsman for assistance. Currently no complaints have been lodged with the Ombudsman.

Once a complaint is resolved and closed, if a breach or non-compliance with the Motor Accident Injuries Act 2017 or Motor Accidents Compensation Act 1999 or regulations is suspected, a case is referred to our Compliance Investigations and Prosecutions team for consideration.

| Category | Number | Key themes |

|---|---|---|

| Green Slip Check | 171 | System issues and insurer pricing |

| Non-complex complaints (generally resolved within two business days) | 176 | Around 80% are about insurer claims management |

| Escalated complaints | 64 | About complex matters or escalated at customer request. See following section |

| Total resolved | 411 |

Escalated complaints this quarter

This quarter, 64 escalated complaints were resolved by our Senior Complaints Advisory team.

- Twenty-five were about insurer delays in making decisions about payments, liability decisions and treatment

- Eleven were about denial of liability or treatment

- Eight were communication issues between the insurer and legal representative

- Twenty were about a range of matters.

Fifty-five per cent of the claims-related escalated complaints are about the 1999 Scheme, and 45 per cent are for the 2017 scheme.

Response times this quarter

We aim to resolve non-complex complaints within two working days, and most escalated complaints within 20 working days.

Our average time to resolve complaints this quarter was:

| Green Slip check | 1 day |

| Non-complex complaints | 1 day |

| Escalated complaints | 17 days |

Investigations

In the December quarter, 39 matters involving alleged breaches of the 2017 Act and the Motor Accident Guidelines by an insurer were escalated to the Compliance, Enforcement & Investigations (CE&I) team under the new complaints process.

A total of 19 matters were finalised during this quarter, which includes matters received by the CE&I team prior to the implementation of the centralised complaints process.