Print PDF

Agency Information Guide

1. Introduction

The Government Information (Public Access) Act 2009 (GIPA Act) provides members of the public with a right of access to government information.

Under the GIPA Act, each NSW Government department and agency is required to publish an Agency Information Guide. This Agency Information Guide provides a general description of:

- The structure and functions of SIRA

- Ways in which the functions of SIRA affect members of the public

- How members of the public can participate in the formulation of SIRA policies and provide feedback

- The types of information held by SIRA

- The types of information that SIRA makes available to the public, and how to access it

- The fees and charges required to be paid to access different types of information.

2. About SIRA

On 1 September 2015, SIRA was established as the independent regulator of the workers compensation, compulsory third party (CTP) and home building compensation insurance schemes under the State Insurance and Care Governance Act 2015 (SICG Act). SIRA also has some regulatory functions in other NSW insurance schemes including the lifetime care and support and dust diseases schemes.

Collectively, these schemes provide an important social safety net for the people of NSW who may one day experience injury or loss. At any one time, more than 10 million people are protected through a SIRA-regulated scheme. These schemes are funded by more than 6 million vehicle owners, employers and homeowners who together pay more than $7 billion in premiums each year.

2.1 Principal objectives

SIRA’s objectives and regulatory role are set out in section 23 of the SICG Act:

- To promote the efficiency and viability of the insurance and compensation schemes established under the workers compensation and motor accidents legislation and the other Acts under which SIRA exercises functions

- To minimise the cost to the community of workplace injuries and injuries arising from motor accidents and to minimise the risks associated with such injuries

- To promote workplace injury prevention, effective injury management and return to work measures and programs

- To ensure that persons injured in the workplace or in motor accidents have access to treatment that will assist with their recovery

- To provide for the effective supervision of claims handling and disputes under the workers compensation and motor accidents legislation

- To promote compliance with the workers compensation and motor accidents legislation.

2.2 Functions

Under section 24 of the SICG Act, SIRA’s functions include those that are conferred or imposed on it by or under that Act or any other Act (including under the workers compensation and motor accidents legislation and the Home Building Act 1989).

These functions also include:

- To collect and analyse information on prudential matters in relation to insurers under the workers compensation and motor accidents legislation and the Home Building Act 1989

- To encourage and promote the carrying out of sound prudential practices by insurers under that legislation and the Home Building Act 1989

- To evaluate the effectiveness and carrying out of those practices.

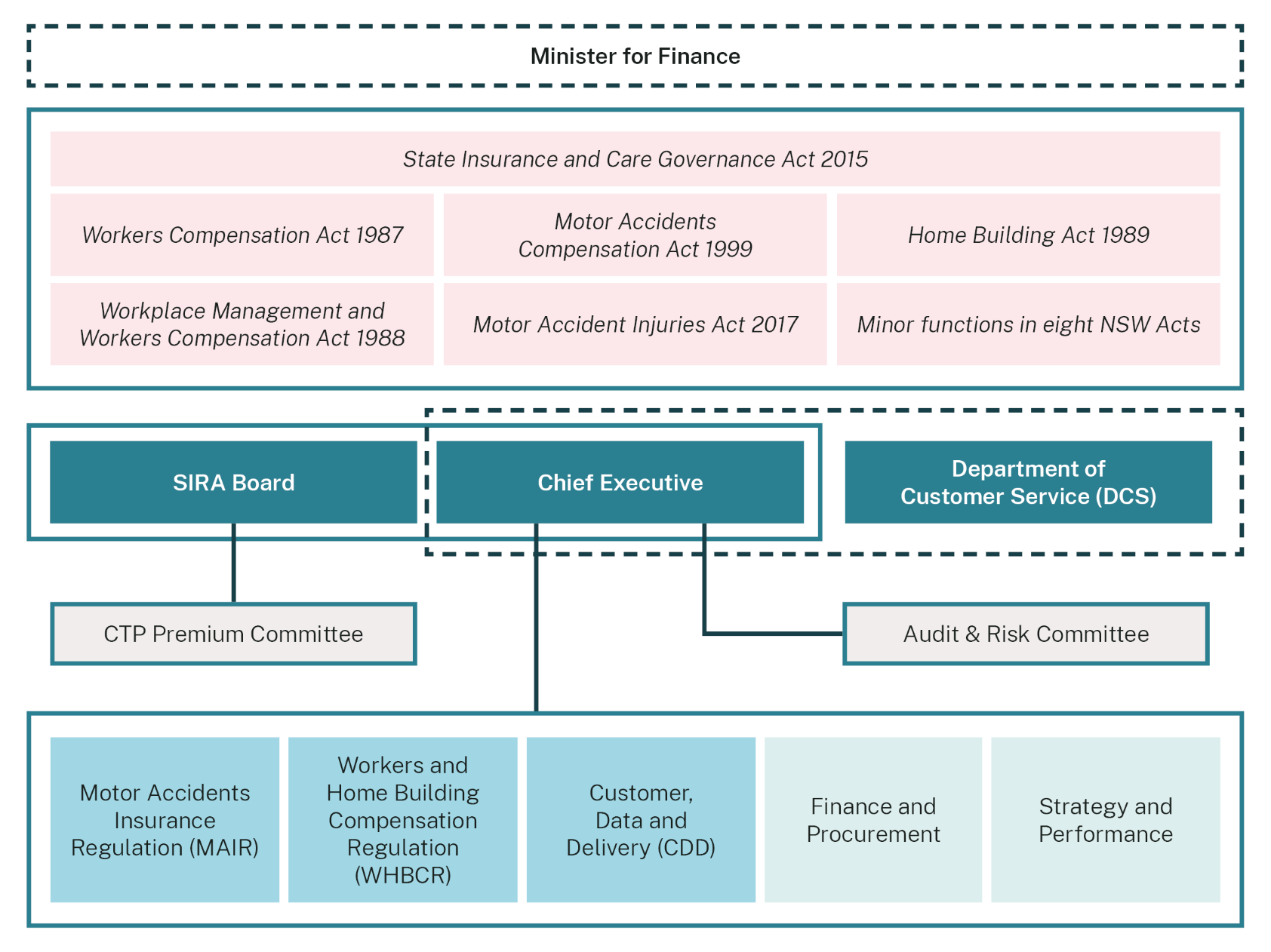

3. Our structure

SIRA is an independent agency within the NSW Department of Customer Service (DCS) portfolio. It is headed by a Chief Executive who manages and controls the affairs of SIRA in accordance with the general policies and strategic direction set by the SIRA Board. Anything done by the Chief Executive on behalf of SIRA is taken to have been done by SIRA (section 19(3) of the SICG Act).

While SIRA is not, in the exercise of its functions, subject to the control and direction of the Minister, the Minister may give SIRA a written direction with respect to its functions if the Minister is satisfied that it is necessary to do so in the public interest.

The structure of SIRA is as follows:

3.1 SIRA Board

The functions of the SIRA Board are set out in section 18(5) of the SICG Act and include:

- Determining the general policies and strategic direction of SIRA

- Overseeing the performance of SIRA

- Giving the Minister any information relating to the activities of SIRA that the Minister requests

- Keeping the Minister informed of the general conduct of SIRA’s activities and any significant development in activities.

The SIRA Board is comprised of seven members who have extensive professional experience both within Australia and internationally.

The Chief Executive is a member of the SIRA Board in an ex-officio capacity, along with the Secretary of DCS, or their nominated delegate. A further five independent members are appointed by the Minister for Better Regulation and Fair Trading.

The chair and deputy chair are selected by the Minister from the five appointed members.

More information about the SIRA Board is available here.

3.2 Compulsory Third Party (CTP) Premium Committee

The SIRA Board established the Compulsory Third Party (CTP) Premium Committee under section 10.3 of the Motor Accident Injuries Act 2017 and section 22 of the SICG Act. The SIRA Board appointed the CTP Premium Committee as an expert advisory committee concerning matters pertaining to CTP insurance premiums.

More information about the CTP Premium Committee can be found here.

3.3 The Audit and Risk Committee

The Audit and Risk Committee was established by the Chief Executive, in compliance with the Internal Audit and Risk Management Policy for the NSW Public Sector (TPP15-03). The objective of the Committee is to provide independent assistance to the SIRA Chief Executive by monitoring, reviewing and providing advice about SIRA’s governance processes, risk management and control frameworks, and its external accountability obligations.

3.4 The SIRA teams

Motor Accidents Insurance

The Motor Accidents Insurance Regulation (MAIR) team oversees the NSW CTP insurance scheme. Insurers licensed to operate in the scheme protect vehicle owners from liability if their vehicle causes injury or death to other road users. The team works hard to reduce injuries and deaths on the roads by having a forward-thinking, proactive, and collaborative approach with stakeholders. The team focuses on delivering better outcomes for policyholders and injured people, and encouraging innovation, quality performance and positive customer experiences. The teams within MAIR include:

Insurer Supervision

The insurer supervision team ensures the compliance and performance of insurers aligns with legislation, guidelines, and community expectations. This team engages with and holds insurers to account to ensure better outcomes and experiences for customers.

Scheme Design, Policy and Performance

This Scheme Design, Policy and Performance team ensures the viability, affordability and sustainability of the CTP insurance schemes under the motor accidents legislation. This is done by shaping and refining policy design, supporting effective and fair legal access to justice, and enabling transparent external engagement.

Health Policy, Prevention and Supervision (HPPS)

The HPPS team promotes optimal recovery and health outcomes in both the workers compensation and CTP schemes. It does this through a value-based healthcare approach, strategic initiatives focused on injury prevention, supervising and educating health providers, and supporting effective fees regulation.

Premiums and Markets

The Premiums and Markets team establishes premiums parameters for the compulsory schemes regulated by SIRA to ensure premiums are affordable, equitable and fair for NSW customers. At the same time, the team monitors the schemes to ensure they are adequately funded for long-term viability.

Workers and Home Building Compensation Regulation

The Workers and Home Building Compensation Regulation (WHBCR) team oversees the workers compensation and home building compensation insurance schemes in NSW.

The team has some involvement in certain aspects of dust diseases, sporting injuries, coal mines, bush fire, and emergency and rescue services legislation. The team focuses on customers and delivering effective regulation that builds public trust and supports NSW in being a competitive, confident, and protected state. The teams within WHBCR include:

Insurer Supervision

Insurer Supervision serves to ensure that insurers comply with their regulatory obligations and effectively deliver claimant and policyholder outcomes while maintaining scheme affordability and sustainability. This team is the frontline interface with licensed and prospective insurers and plays a key role in setting expectations and ensuring that they are met.

Scheme Design, Policy and Performance

This team helps SIRA and its stakeholders to better understand how the workers compensation scheme operates. It provides advice on key risks, issues and opportunities, and develops policy options in collaboration with stakeholders to inform legislative change.

Employer Supervision and Return to Work

The Employer Supervision and Return to Work team supports employers to comply with their workers compensation obligations. It also promotes the importance of injured people recovering through work in both the workers compensation and compulsory third-party schemes. It does this through strategic programs and resources, stakeholder education and regulatory action.

Investigations and Enforcement

The role of the Investigations and Enforcement team is to ensure regulatory compliance by prosecuting breaches, enforcing the law, and undertaking punitive actions. The primary goal of its work is to contribute to higher levels of public trust in the workers compensation, CTP and home building insurance systems.

Performance and Compliance Reviews

This team conducts audit and review activities that enable SIRA to hold system participants accountable for their regulatory performance and compliance. This team addresses significant and systemic performance and compliance risks, pursues continuous improvement in regulatory practice and system outcomes, and undertakes specific rulings and reviews.

Home Building Compensation Regulation (HBCR)

In October 2022, SIRA established a new Home Building Compensation Regulation directorate to enhance the regulation of the home building compensation scheme. The team brings together multiple functional areas within SIRA to effectively regulate insurers, proactively engage with stakeholders, manage scheme risks and deliver scheme outcomes. The teams within HBCR include regulatory policy, insurer supervision and home building compensation enforcement.

Customer Data and Delivery

The Customer, Data and Delivery (CDD) team works across SIRA to connect, deliver and promote ideas and services that drive measurably better customer outcomes, underpin regulatory excellence and accelerate progress on SIRA’s strategic goals.

CDD is comprised of teams focused on regulatory intelligence and analytics, digital projects, data analytics, branding and communication, customer service and operations and delivery and insights. These teams bring together customer, data, digital, delivery, insights and SIRA’s research functions with a focus on building internal capability and consolidating accountability of the various platforms, services and products that SIRA uses. The teams within CDD include:

Customer Service and Operations

This team delivers a range of advisory and transactional services to policy holders and claimants and shares customer insights with teams across SIRA to inform their functions and work. The team is also responsible for a number of statutory review processes.

Delivery and Insights

This team helps SIRA to better understand its customers and to deliver meaningful change that benefits them, supporting the organisation through market research and integrated insights, outcome-focused delivery practices, and fostering a customer-centric culture.

Regulatory Intelligence and Analytics

The Regulatory Intelligence and Analytics (RIA) team support SIRA as a data-driven and intelligence-led organisation to deliver improved regulatory outcomes. RIA provides valuable insights to support SIRA’s evidence-based decision-making and transparent reporting to NSW citizens on scheme performance.

Digital

The Digital team is responsible for delivering, managing, enhancing, and supporting the digital platforms that enable SIRA to be an intelligence-driven, risk-based regulator, with a focus on simplifying, modernising, and consolidating the technology platforms used at SIRA.

Media and External Communications

The Media and External Communications team supports SIRA to communicate and engage with its external audiences. A major focus is ensuring SIRA continues to create content that showcases achievements against SIRA’s strategy - SIRA2025 - and builds brand equity through promoting SIRA and the work it does, increasing regulatory transparency and responding to the strategic environment and public scrutiny.

The Office of the Chief Executive

The Office of the Chief Executive oversees the development and delivery of key corporate functions, including finance, procurement, strategy, governance, risk, compliance, and staff engagement. In addition to the Office of the Chief Executive’s key executive functions, there are two directorates that support SIRA’s governance and the delivery of SIRA’s strategic priorities. The two directorates are:

Finance and Procurement

This team is SIRA’s point of reference for assistance and guidance on procurement, budgeting, and financial matters and SIRA’s delegations.

Strategy and Performance

Strategy and Performance ensures SIRA’s strategic, corporate, and business plans and objectives are enabled through the provision of a range of critical enabling services to optimise SIRA’s governance, public accountability and capability. Strategy and Performance delivers SIRA-wide functions that support the implementation of its strategic goals and priorities as outlined in the SIRA2025 Strategy.

4. How SIRA engages with the public

SIRA engages with a range of stakeholders who are interested in or directly impacted by the decisions SIRA makes.

We believe the quality of our stakeholder engagement determines how well we deliver on our purpose to make sure that NSW insurance schemes protect and support the people who need them, now and in the future.

SIRA has established a number of engagement channels including its website, social media, and other communication channels to facilitate the sharing of key information and feedback between SIRA and the public.

4.1 SIRA engagement channels

SIRA website

The SIRA website is used to provide the public with resources and information about SIRA’s regulatory functions, quarterly regulatory updates, news articles, law reforms, policy developments, factsheets, advice, and consultations in the workers compensation, CTP, and home building insurance systems.

News

News on the SIRA website is a digital platform where stakeholders can learn more about the work SIRA does. Rather than simply reporting on SIRA activities, articles published here explain why we are doing what we are doing and what it means for our stakeholders. Users can filter articles by date, scheme and publication type, search for keywords and discover related information.

The News page is also populated with news articles about SIRA’s compliance and enforcement activity, law reforms, updated policies and guidelines, open consultations, SIRA’s bulletins and more.

Subscribe to the SIRA bulletin.

Consultations

To ensure that the public get an opportunity to participate in the formulation of SIRA’s policies, SIRA welcomes submissions on proposed projects, guidelines, services, policies and law reforms via the consultation page on the SIRA website.

Key stakeholders, including members of the public, have the opportunity to contribute to important regulatory updates and reforms by completing an online form. You can read more about the consultation submission procedure.

SIRA also utilises ‘Have Your Say', a website that enables NSW Government agencies to publicise consultations being conducted throughout the State as an additional channel to engage the public in the consultation process.

Surveys

SIRA has an ongoing customer experience research program which aims to understand the experiences of individuals who have been injured and have filed claims for compensation.

The program conducts surveys to determine how customers view the compensation experience and how closely insurers align with SIRA’s Customer Service Conduct Principles. The research provides valuable insights into how people interact with workers compensation and CTP schemes, and how these interactions affect their recovery process.

SIRA is committed to continue this research program and will use the results to inform and improve its regulatory supervision activities. Further details on this survey and the study taken by SIRA are available on our customer experience research page.

Social media

The SIRA LinkedIn account is used to promote and encourage connections with SIRA by other organisations, agencies, and members of the public. This channel is used to increase awareness of public consultations, launches, events, law reforms, policy developments, compliance and enforcement activity and outcomes, and organisational changes.

The SIRA YouTube channel is used as a platform to provide information regarding the claims process, share real stories about the return to work journey, and share informative videos regarding the workers compensation, CTP, and home building compensation schemes.

SIRA uses closed captioning on its videos wherever possible, and transcripts are available along with the standard accessibility options available from YouTube. A select few videos can also be watched in Arabic, Cantonese, Korean, Vietnamese, Greek and Mandarin.

OpenGov Data

OpenGov NSW is a website that allows NSW Government agencies to make information available to the public including annual reports and open access information released under the GIPA Act. SIRA utilises the OpenGov NSW website to publish annual, scheme and performance reports, as well as statistical bulletins.

All of SIRA’s publications published on OpenGov NSW are available here.

Open Data

SIRA continues to make detailed scheme performance data available via interactive open data portals on its website. The workers compensation and CTP open data portals provide self-service visual analytics tools to make it easy to view and compare scheme data and insurers' performance over time. SIRA also publishes regular reports on key system trends and actions.

4.2 Feedback and complaints

SIRA welcomes input and feedback from the public, community organisations and government agencies regarding its services and publications. This feedback is important to SIRA as it assists in informing its policies and publications and improving its services.

SIRA receives a range of diverse correspondence and complaints through a variety of channels including online forms, emails, mail, and phone calls.

SIRA handles two main types of complaints:

- Complaints About Regulated Entities: These are managed according to the SIRA Complaint Handling Policy, which can be found here.

- Complaints About SIRA and SIRA Services: Complaints directly related to SIRA’s services are managed under the DCS Customer Service Complaint Handling Policy, available here.

For complaints specifically, related to the handling of GIPA requests, please refer to the DCS Customer Service Complaint Handling Policy. This document outlines the review process and your rights under such circumstances.

5. Types of information held by SIRA

SIRA holds a wide variety of information regarding its functions and operations.

Presented below are the major categories of information and the various types of information in each category:

Major Categories | Types of Information |

|---|---|

Workers Compensation |

|

Motor Accidents (CTP) |

|

Home Building Compensation |

|

Strategy and Governance | |

Open Access Information |

|

6. How to access information held by SIRA

6.1 Proactive release of information

Agencies are encouraged to go beyond the minimum mandatory disclosure requirement unless there is an overriding public interest against disclosure.

SIRA has available the open data analytics tool to facilitate public access to CTP and workers compensation data, and a disclosure log of information that SIRA has released following an informal access application, which may be of interest to other members of the public.

Under a regulatory publishing policy launched in June 2022, SIRA has improved its transparency of insurer and regulated entity performance in the workers compensation, CTP, and home building compensation schemes by committing to routinely publish more information about its compliance and enforcement activity via its existing publishing channels.

SIRA will continue to communicate its regulatory activity through a variety of mediums, including media statements, bulletins, news articles and quarterly regulatory updates.

6.2 Informal access applications

If information sought by a member of the public is not available on SIRA’s website, is not otherwise routinely provided by SIRA, and raises no particular concerns in terms of possible public interests against its disclosure, SIRA may be able to release the information informally without requiring a formal application to be made.

Generally, the following information may be released informally:

- Data requests

- SIRA publications including policy documents, manuals and/or reports

- Records that contain only the personal information of the individual requesting the record

- Copies of correspondence between an individual and SIRA, if the applicant is the person who SIRA corresponded with.

It is important to note that under the GIPA Act, SIRA has no legal obligation to disclose information on an informal basis. SIRA reserves the right to require the lodgement of a formal access application, particularly if there may be significant public interest considerations that need to be considered in deciding whether the information can be released, or if it would take SIRA a significant amount of time to consider and respond to a request.

An informal request for access to information can be made by contacting the Information Access team by email or post. See Contact us for more details.

6.3 Formal access applications

A formal access application for information held by SIRA can be submitted by a member of the public at any time. Formal access applications are typically required where the information being sought needs to be assessed against public interest considerations against disclosure as set out in the table to section 14 of the GIPA Act, is more complex in nature, large in scope, is non-personal, and/or will require third-party consultation.

How to make an application

To make a formal access application for information held by SIRA, an access application must:

- be in writing

- be sent to the Information Access team via email or pos - see Contact us for more details

- clearly state the information is being sought under the GIPA Act

- be accompanied by the application fee of $30

- clearly state the name of the applicant and a postal or email address for correspondence in connection with the application

- provide as much information as is reasonably necessary to enable the information being requested to be identified.

If personal information is being sought, a valid copy of identification (e.g., driver’s licence, NSW Government issued photo card, passport, or other proof of ID) must accompany the application.

Alternatively, a formal access application form can be downloaded from the SIRA website, completed, and forwarded to the Information Access team by email or post. See Contact us for more details.

Fees and charges

The application fee for a formal access application must be paid by electronic funds transfer (EFT) to:

Account name: State Insurance Regulatory Authority

Bank: Westpac Banking Corporation

BSB: 032-001

Account number: 112713

Reference: Your Surname – GIPA

A remittance advice must accompany your formal access application.

In certain circumstances, a formal access application may be subject to the following fees and processing charges:

Type of Access Applications | Application Fee | Processing Charges |

|---|---|---|

Access to information of a personal nature | $30.00 | The first 20 hours is covered by the application fee, after which a charge of $30.00 per hour may apply. |

Access to information of a non-personal nature | $30.00 | A processing charge of $30.00 per hour is applicable for non-personal information. |

Internal Review of a decision | $40.00 | Not applicable. |

An applicant may be eligible for a 50% discount on processing charges if the applicant:

- holds a valid Pensioner Concession Card

- holds a valid Healthcare Card

- is a full-time student

- is a non-profit organisation (including a person applying for or on behalf of a non-profit organisation)

- is suffering financial hardship

- is applying for information that is of special benefit to the public.

An advance deposit of up to 50% of the total estimated processing charge may also be requested by SIRA. This will happen after consideration of the application and an assessment of the chargeable time required to identify and consider the release of relevant information. Should this be applicable to an application the applicant will be advised of the estimated processing charge and will be given at least four weeks for payment.

What happens after you lodge a formal access application?

SIRA will contact the applicant if it is necessary to clarify any aspect of the application.

The applicant will receive correspondence acknowledging receipt of their application within 5 working days advising the application is valid.

SIRA will make a decision within 20 working days of receiving a valid formal access application and notify the applicant of the outcome. This time can be extended by 10 working days where the GIPA Act requires consultation with a third party or for the retrieval of records from archives, or a total of 15 working days if both circumstances apply. A request for an advance deposit may also extend the statutory time period.

A formal access application can only be made for information held at the time the application is received. SIRA is required to consult with a third party in certain circumstances where an applicant requests information that includes:

- personal information about another person

- business information of a third party (including another government agency)

- information concerning the affairs of the Commonwealth Government or another state government.

Making a decision on a formal access application

A decision on a formal access application can only be made by an authorised GIPA officer. SIRA must refuse access to certain information outlined in Schedule 1 of the GIPA Act, as there is a conclusive presumption of an overriding public interest against disclosure.

Examples of these certain types of information include:

- Information that was prepared for the dominant purpose of submission to Cabinet.

- Information subject to legal professional privilege.

Where an access applicant requests information that does not fall within one of the specified categories of information listed in Schedule 1 of the GIPA Act, SIRA must apply a public interest test. The public interest test requires SIRA to consider public interest considerations favouring disclosure of the information requested and weigh them against the public interest factors that do not favour disclosure of the same information, which are specified in the table to section 14 of the GIPA Act.

Examples of public interest factors favouring the disclosure of information include but are not limited to the following:

- Promote discussion of public affairs

- Enhance accountability

- Inform the public about the operations of agencies

- Ensure effective oversight of the expenditure of public funds

- Reveal or substantiate misconduct or negligent, improper, or unlawful conduct.

The above factors that favour disclosure are then weighed against any public interest considerations against disclosure.

The public interest considerations against disclosure as listed in the GIPA Act are:

- Disclosure would prejudice the conduct, effectiveness or integrity of any audit, test, investigation, or review conducted by or on behalf of an agency by revealing its purpose, conduct or results (whether or not commenced and whether or not completed)

- Disclosure would prejudice the supply to an agency of confidential information that facilitates the effective exercise of that agency’s functions

- Disclosure would reveal an individual’s personal information

- Disclosure could reasonably diminish the competitive commercial value of any information to any person, or prejudice any person’s legitimate business, commercial, professional, or financial interests.

Under section 60(1)(a) of the GIPA Act, SIRA can also refuse to deal with an access application, in whole or in part, if dealing with the application would require an unreasonable and substantial diversion of the agency’s resources.

Rights of review

In addition to the review options outlined in the ‘Feedback and Complaints’ section, if your concern is specifically related to how SIRA has handled your information access request, it may be addressed under the DCS Customer Service Complaint Handling Policy. This policy provides guidance on how to escalate a complaint about the conduct of SIRA in handling your request to ensure the request was managed in accordance with the agency’s customer service principles and procedures. For more information or to make a complaint about a GIPA-related issue, please visit the Feedback and Complaints Section.

A complaint about how SIRA has handled a GIPA request is different to requesting a review of SIRA’s decision on an access application. If you are dissatisfied with the outcome of a GIPA decision made by SIRA in response to your application for information under GIPA, a formal access applicant has the right to request:

- Internal review by SIRA: This must be sought within 20 working days of a notice of decision, accompanied by a fee of $40, which can be waived. If the review is a ‘deemed refusal’ or as advised under section 93 of the GIPA Act, no fee is charged. An officer not involved in the original decision will conduct a review and issue a new decision within 15 working days.

- External review by the Information Commissioner: No fee is required for this review, which can be sought if there are concerns about how SIRA handled the application.

- External review by the New South Wales Civil and Administrative Tribunal: NCAT may charge a fee for review, with concessions available in certain circumstances.

Each review option has its own procedures and implications. It is important to choose the one that best suits your needs and the specifics of your case. For more detailed information on these processes or to initiate a review, please contact the relevant authority directly.

6.4 Mandatory proactive release of information

Documents tabled in Parliament

SIRA is required by the GIPA Act to provide access to information that has been tabled in the NSW Parliament by or on behalf of SIRA. This requirement is intended to make the operations of government more transparent to the Australian public.

SIRA related documents tabled in Parliament can be found here.

Policy Documents

SIRA has a number of policy documents which support internal and external operational procedures and processes. As SIRA is an independent agency located within the DCS portfolio, our staff management is also supported by DCS policies.

SIRA policy documents can be found within our list of publications on the SIRA website.

Disclosure Log

Our disclosure log is a record of information that SIRA has released following a formal access application, which may be of interest to other members of the public.

The disclosure log provides members of the public with details regarding:

- The date the application was decided.

- A description of the information to which access was provided.

SIRA’s disclosure log is updated on a quarterly basis. You can find SIRA’s disclosure log here.

Register of Government contracts

Part 3 Division 5 of the GIPA Act sets out information about an agency's responsibility to publish contracts worth $150,000 or more on their website.

Please see SIRA’s register of current, proposed, closed, and archived requests for tenders and contracts at NSW eTendering.

6.5 Alternative means to access information held by SIRA

Insurance search

Information regarding workers compensation insurance claims, policy and settlement records held by SIRA can also be accessed by completing an Application for workers compensation insurance claims, policy and settlement records, and forwarding it to one of the following:

Email: [email protected]

Writing to:

State Insurance Regulatory Authority

Customer Experience

Locked Bag 2906

Lisarow NSW 2252

Subpoenas and summons

A subpoena or a summons is a tool for parties to use to obtain documents or evidence that could have relevance to issues before a court or tribunal.

Subpoenas to produce documents must be accompanied by conduct money of $30.00. The conduct fee must be paid by electronic funds transfer (EFT) to:

Account name: State Insurance Regulatory Authority

Bank: Westpac Banking Corporation

BSB: 032-001Account number:112713

Reference: Plaintiff Surname – Subpoena

A remittance advice must accompany the subpoena or summons.

Subpoenas and summons addressed to SIRA should be sent to [email protected] or by post. See Contact us for more details.

7. Contact us

If you have any questions or require further information or advice regarding accessing information held by SIRA, please contact the Information Access Team by:

Phone: 13 74 72

Email: [email protected]

Writing to:

State Insurance Regulatory Authority

Information Access

Public Accountability

Locked Bag 2906

Lisarow NSW 2252

For more information about the GIPA Act and your right to access information contact the NSW Information and Privacy Commission (IPC) by:

Phone: 1800 472 679

Email: [email protected]

Writing to:

NSW Information Commissioner

Level 17, 201 Elizabeth Street

Sydney NSW 2000

8. Document control

Last updated: October 2023

Next scheduled review: Second quarter, 2024