Print PDF

Motor accident guidelines: claims handling and medical (treatment, rehabilitation and care)

Introduction

The Motor Accidents Compensation Act 1999 (the Act) sets out clear performance objectives for the motor accidents scheme (the scheme). In brief, the objectives relating to claims are to provide for early and appropriate treatment of injuries to achieve optimum recovery, to provide fair compensation and to encourage the early resolution of claims.

To facilitate the achievement of the statutory objectives and deliver outcomes to injured people making claims, the Act:

- establishes a framework for making and resolving compensation claims fairly and promptly

- empowers the State Insurance Regulatory Authority, (the Authority) to issue guidelines that build upon the legislative framework

- requires the Authority to operate within the claim process framework to resolve claims disputes

- places duties upon the parties to a claim to act on the claim

- requires the Authority to regulate insurers operating within the scheme and report on the scheme

- requires insurers take all reasonable steps to detect and prevent the making of fraudulent claims.

Through the Motor Accident Guidelines: Claims handling and medical (treatment, rehabilitation and care) (the Guidelines) and the associated compliance process, the Authority seeks to support the delivery of scheme claims handling outcomes by:

- promoting insurer handling of claims that is consistently undertaken in accordance with the requirements (as set out in the Act, guidelines etc.) and the objectives of the scheme

- building upon claims handling provisions in the Act and clarifying what is expected of insurers when they handle a claim

- establishing a high standard of service for all injured people regardless of their entitlements or the insurer against whom they make the claim, while providing insurers with the opportunity and incentive to exceed those standards.

These Guidelines have been prepared with the aim of:

- setting out mandatory provisions relating to timely and fair handling of claims

- supporting the handling of claims in a manner that preserves compensation for those suffering genuine injury and loss

- prescribing mandatory procedures for critical common claim events

- prescribing a process to ensure appropriate treatment and facilitation of rehabilitation to meet the needs of injured people

- prescribing complaints handling and dispute resolution principles.

These Guidelines are issued under sections 44, 68 and 173 of the Act and should be read in conjunction with the relevant provisions of the Act. Guidelines issued under section 44 have the force of statutory rules while those issued under sections 68 and 173 are conditions of an insurer’s licence.

Compliance and enforcement is undertaken by the Authority in accordance with the Authority’s Compliance and enforcement policy.

Application of these Guidelines

These Guidelines commence on 1 January 2017 and remain in force until they are amended or replaced. The Guidelines will supersede previous Claims Handling Guidelines and Treatment, Rehabilitation and Attendant Care (TRAC) Guidelines issued by the Authority, for all claims and notifications made on or after the date of commencement.

Claims handling decisions and actions on all current claims after the commencement date will be expected to comply with the Guidelines.

Structure of the Guidelines

The revised Guidelines are significantly different from previous versions in both content and approach.

Most notably they include a single set of Claims Handling Guidelines to promote simplicity and an integrated approach to claims handling, these Guidelines contain:

- Claims Handling Guidelines made under section 68 of the Act directing how insurers and those acting on their behalf are to deal with claims clarification of the expectation of insurers under section 116 of the Act to take all such steps as may be reasonable to deter and prevent the making of fraudulent claims

Guidelines made under section 173(4) of the Act relating to the business plans of licensed insurers and

Information on how an insurer is to exercise its duties under section 84A of the Act to make payments to an injured person, once liability (wholly or in part) has been admitted, in respect of economic loss to the extent necessary to avoid the injured person suffering financial hardship.

Guidelines made under section 44 of the Act (MAA Medical Guidelines, formerly dealt with separately in the TRAC Guidelines)

| Section of Motor Accidents Compensation Act 1999 | Clauses in these Guidelines made under these sections of the Act: |

|---|---|

| Medical Guidelines made under section 44 of the Act | - 1.1.5 to 1.1.7 inclusive - 1.2.1 - 2.1 to 2.6 inclusive - 3.2 to 3.5 inclusive - 10.3 to 10.8 inclusive - 12.1 to 12.10.2 inclusive |

| Claims Handling Guidelines made under section 68 of the Act | - 1.1 to 1.1.4 inclusive - 1.2.2 to 1.5.4 inclusive - 3.1 to 3.1.2 inclusive - 3.6 to 3.7 inclusive - 4.1 to 4.5 inclusive - 5.1 to 5.5 inclusive - 6.1 to 6.4 inclusive - 7.1 to 7.2.2 inclusive - 8.1 to 8.4 inclusive - 9.1 to 9.6 inclusive - 10.1 to 10.2 inclusive - 10.9 to 10.15 inclusive - 11.1 to 11.3 inclusive - 14.1 to 14.1.4 inclusive - 15.1 to 15.8.2 inclusive - 16.1 to 16.6 inclusive - 17.1 to 17.2.3 inclusive |

| Business Plan Guidelines made under section 173 of the Act. | - 18.1 to 18.3 inclusive |

| Financial hardship section 84A | - 13.1 to 13.6 inclusive |

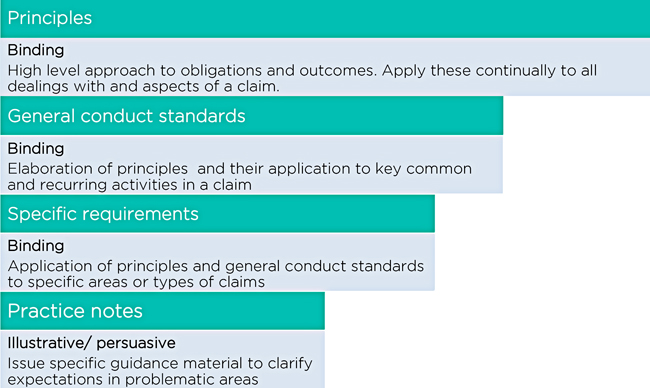

- Overarching claims handling principles which make clear the outcomes insurers are to achieve in the handling of claims. The principles are all pervasive and therefore apply to all dealings on a claim. While the principles apply generally, the Guidelines also include:

- General conduct standards (standards) which elaborate upon the principles and their application to key common and recurring activities in a claim

- Specific requirements (requirements) which apply the principles to specific claims issues or types of claims that are technical or non-recurring

- A risk based approach – the Guidelines focus on matters that are considered to be important to achieving scheme objectives and claims handling outcomes

- A requirement for insurers to submit business plans – insurers will be required to provide an annual business plan to the Authority, with details about how insurers will make sure that their claims operations are consistent with the Guidelines, and in particular how they satisfy the principles contained in the Guidelines.

The Authority will provide ongoing support for insurers in the interpretation and application of the Guidelines. The Guidelines are supported by an initial suite of Practice Notes, with additional Practice Notes to be developed over time as issues emerge.

The interplay between principles, general conduct standards, specific requirements and practice notes as well as their application is shown below.

Claims handling principles

The five principles below apply throughout the claim - this means that insurers must act in accordance with all of the principles at all times and on all dealings with all claims.

Principle 1: The insurer will always act to resolve the claim justly and expeditiously

This principle elaborates on the general duty of insurers under section 80 of the Act.

The intention of the principle is to promote the prompt determination of liability by insurers, the prompt making of reasonable offers of settlement for claims in which liability is accepted and the prompt payment of compensation in accordance with the injured person’s entitlements.

It should be emphasised that the principle operates across all aspects of claims handling, including investigating claims, decision making, making payments and dispute handling.

Acting ‘justly’ entails ‘doing the right thing’, acting fairly and in accordance with the rules when handling all aspects of a claim.

Acting ‘expeditiously’ includes taking initiative to progress a claim and avoiding delay, whether or not specific timeframes or standards have been set in the rules.

Principle 2: The insurer will handle the claim proactively to support the injured person to optimise their recovery

This principle is intended to provide clarity around the elements of the duty of insurers with respect to the rehabilitation of an injured person under section 84 of the Act.

The principle confers a requirement to make diligent and prompt enquiries with respect to an injured person’s treatment, rehabilitation and attendant care needs and to provide timely and appropriate assistance throughout the life of the claim.

Principle 3: The insurer will act objectively and openly, with honesty and professionalism at all times in its handling of the claim

This principle is directed at how insurers and their agents handle claims – it is aimed at ensuring that appropriate standards of behaviour are adhered to and that a culture of transparency, trust and respect is promoted within the Scheme.

Importantly, the insurer must act to ensure, to the extent possible, that the service experience of the injured person is a good one, irrespective of whether the claim is in dispute or not, or the insurer’s views on the validity of the claim, or the demeanour of the injured person (or their legal representative).

The insurers must be consistent in their claims handling approach, must not mislead or obfuscate, and cannot use prejudicial or unduly discriminatory factors when handling claims.

Principle 4: The insurer will act on each claim in a manner that promotes the integrity of the claim

This principle is intended to remind insurers of their obligation under the Act to deter and prevent the making of fraudulent claims.

Insurers are required to take all such steps as are reasonable to investigate and quantify each claim in accordance with the Act and only pay claims in accordance with the Act.

Principle 5: The insurer will keep the injured person informed at all times of the status and progress of the claim

This principle is intended to foster greater balance in the relationship between the injured person and the insurer and promote the progress of the claim to resolution by proactively advising the injured person of the status of the claim, next steps and expected timeframes, in plain language and in a timely fashion.

Consultation with stakeholders, especially injured people, who have made claims, has shown examples of substandard communication including untimely communication, misleading and inaccurate correspondence and the use of ‘legalese’ and jargon.

This principle aims to ensure that injured people remain informed so that poor communication does not delay the progress and payment of claims and result in a poor experience for injured people seeking to recover compensation.

Defined words and interpretation

Defined words

Accident notification form (ANF)

The form under Part 3.2, in section 49 of the Act

Act

The Motor Accidents Compensation Act 1999, as amended from time to time.

Agent

Any representative of an insurer, acting on behalf of or providing services to an insurer in respect of a claim, including but not limited to, medical or allied health professional, private investigator and legal service provider.

Authority

The State Insurance Regulatory Authority a NSW Government agency constituted under section 17 of the State Insurance and Care Governance Act 2015.

CARS

The Motor Accidents Claims Assessment and Resolution Service of the Authority constituted under Part 4.4 of the Act.

CAS

The Motor Accidents Claims Advisory Service established under section 206 (2)(e) of the Act.

Claim

A claim for damages in respect of the death of or injury to a person, and in these Guidelines includes an accident notification under Part 3.2 of the Act.

Complaint

Any expression of dissatisfaction with a product or service offered or provided or not provided. It does not include a request for service or information.

CTP insurance

Compulsory third party personal injury insurance

Days

Business days

Dispute

A matter where there is a disagreement with an insurer’s decision that may be referred to the insurer’s dispute resolution process or the independent Motor Accidents Assessment Service, comprising the Motor Accidents Claims Assessment and Resolution Service and the Motor Accidents Medical Assessment Service.

Document

a. anything on which there is writing, or

b. anything on which there are marks, figures, symbols or perforations having a meaning for persons qualified to interpret them, or

c. anything from which sounds, images or writings can be reproduced with or without the aid of anything else

d. a map, plan, drawing or photograph.

Independent health service provider

An expert who is instructed by the insurer or injured person to provide an opinion on their behalf with respect to the claim.

Injured person

A claimant

Insurer

An entity, including any agent of the entity, who is licensed by the Authority under Part 7.1 of the Act.

Joint medical examination

A medical examination conducted by an independent health service provider instructed by both the injured person and the insurer to provide an opinion for both the injured person and the insurer with respect to the claim.

Insurance and Care NSW (icare)

The NSW Government agency that provides services to authorities that provide insurance and compensation schemes in NSW, including the Lifetime Care and Support Authority.

Legally represented claimant/injured person

A claimant/injured person who is represented by an Australian legal practitioner.

Lifetime Care and Support Authority (LTCSA)

The statutory body constituted under section 33 of the Motor Accidents (Lifetime Care and Support) Act 2006.

LTCSA participant

An injured person who has been accepted, on either an interim or lifetime basis, into the Lifetime Care and Support Scheme as provided under the Motor Accidents (Lifetime Care and Support) Act 2006.

MAS

The Motor Accidents Medical Assessment Service established under section 57A of the Act.

Parties

The injured person and the insurer or insurers, if more than one is involved in a claim.

Regulation

The Motor Accidents Compensation Regulation 2015, as amended from time to time, made under Chapter 6 of the Act.

Scheme

The NSW Motor Accidents CTP scheme as constituted by the Act.

TRAC

Treatment, rehabilitation and attendant care services.

Treatment/treating provider

Means and includes any treating medical, rehabilitation or health service provider.

Interpretation notes

Legally represented claimants

In claims where the injured person has engaged legal representation, these Guidelines are to be interpreted so as not to conflict with the role of a legal adviser.

Insurer and representatives of the insurer

The term ‘insurer’ is to be interpreted to include staff and any agent acting on behalf of the insurer, unless staff and/or an agent is referred to specifically, for example in the requirements for the allocation of claims to suitably qualified staff and agents.

Injured person and claimant

For ease of reference and to avoid confusion the conventions employed in the Act in the use of the terms ‘injured person’ and ‘claimant’ have not been applied in the Guidelines. In these Guidelines an injured person means a claimant of any entitlement under the Act.

In addition any reference to injured person is to be interpreted, where relevant, to include a reference to a person making a claim under the Compensation to Relatives Act 1897 and/ or a person making a claim on behalf of another person.

Part A: Principles and general conduct standards

Principle 1: The insurer will always act to resolve the claim justly and expeditiously

General conduct standards

1.1 The insurer will investigate the claim promptly, efficiently and in a cost effective manner and progress the claim to finalisation expeditiously by:

- 1.1.1 acting with proportionality in the handling of all aspects of the claim

- 1.1.2 identifying the issues preventing resolution of the claim

- 1.1.3 requesting documents about the claim in a timely manner and following up on requests regularly

- 1.1.4 assessing and evaluating the documents provided

- 1.1.5 identifying whether there is a need to engage an independent health service provider, considering the most appropriate expert and engaging that expert as early as possible

- 1.1.6 providing the injured person with the opportunity to jointly engage an independent health service provider where the need for an expert has been identified

- 1.1.7 engaging an independent health service provider promptly once an injured person has either failed to respond to or has declined the opportunity to jointly engage an expert.

1.2 The insurer will keep the claim under review at intervals of no greater than three months, the frequency of review reflecting the needs of the injured person, the insurer’s position on liability and the complexity of the claim. During the review of the claim the insurer will:

- 1.2.1 consider the appropriate treatment, rehabilitation and attendant care needs of the injured person and respond to any request for treatment, rehabilitation and attendant care

- 1.2.2 identify and obtain the documents required to make a timely decision on liability and to formulate a reasonable offer of settlement on the claim

- 1.2.3 identify whether the injured person is sufficiently recovered to enable quantification of the claim and if so, to make reasonable offers of settlement to the injured person

- 1.2.4 ensure the insurer’s claim handling obligations are identified and complied with.

1.3 The insurer will make all decisions on the claim, including those relating to the treatment, rehabilitation and attendant care needs of the injured person, based on all the available documents, consistent with the facts and in accordance with the law. The insurer will provide the injured person with:

- 1.3.1 written reasons for decisions in sufficient detail to enable the injured person to understand the reasoning process of the insurer and identify the documents, except for legally privileged documents, that the insurer considered in making the decision

- 1.3.2 an explanation of the impact of the decision on the injured person’s entitlements

- 1.3.3 the process by which an injured person can have a decision reviewed, and where applicable, an outline of the documents that may be required by the insurer to undertake a review.

1.4 The insurer will attend to requests for payment (including payments for treatment, rehabilitation and attendant care) promptly upon admitting liability for the claim in whole or part, and will:

- 1.4.1 make payments as expeditiously as possible, paying particular regard to the insurer’s obligations under specific requirements 12.3 and 15.8

- 1.4.2 pay claims without relying on technical defects, non-compliance with form or irregularities that are minor as they do not cause detriment to the insurer

- 1.4.3 make advance payments of economic loss where necessary to avoid an injured person suffering financial hardship.

1.5 The insurer will act to minimise and resolve disputes when handling a claim, and when a dispute arises the insurer will:

- 1.5.1 provide the injured person with information about the range of options for resolving the dispute

- 1.5.2 provide the injured person with the opportunity of having any decision reviewed by a more senior representative of the insurer independent of the original decision maker

- 1.5.3 make available to the injured person an internal dispute resolution process in the manner/format required by the Authority

- 1.5.4 where internal dispute resolution procedures fail to resolve the dispute, assist the injured person to progress their claim by accessing external dispute resolution, as appropriate.

Principle 2: The insurer will handle the claim proactively to support the injured person to optimise their recovery

General conduct standards

2.1 The insurer will liaise at regular intervals with the injured person’s treatment providers to assist in the identification of the injured person’s treatment, rehabilitation and attendant care needs and act promptly to address these needs.

2.2 The insurer will liaise with the injured person’s treatment providers at regular intervals to monitor their recovery and related treatment, rehabilitation and attendant care needs.

2.3 The insurer will review the claim at regular intervals to determine whether there is a change in the injured person’s treatment, rehabilitation and attendant care needs.

2.4 The insurer will involve the injured person in the development and ongoing review of their treatment, rehabilitation and attendant care plans and programs.

2.5 Where the insurer has recommended a particular treatment provider, the insurer will advise the injured person of their right to choose their own provider.

2.6 The insurer will adhere to the Authority’s injury management guidelines and procedures, in determining the need for and making decisions relating to the injured person’s treatment, rehabilitation and attendant care services.

2.7 Clauses 2.1 to 2.6 are issued under section 44 of the Act.

Principle 3: The insurer will act objectively and openly, with honesty and professionalism at all times in its handling of the claim

General conduct standards

3.1 The insurer will provide full copies of all documents about the claim obtained from third parties using the authority or permission of the injured person as soon as possible, unless the third party concerned indicates in writing that it would be unsafe to do so.

3.1.1 In all but exceptional cases, the insurer will share such documents promptly and no later than 20 days from the date of receipt of the information.

3.2 The insurer will record and retain on the claim file reasons for each of the insurer’s decisions on the claim, including those decisions made in relation to the nature and manner of investigation of the claim, liability for the claim, treatment, rehabilitation and attendant care needs, payments on the claim and quantum of the claim.

3.3 The insurer will assign the claim to appropriate staff and/or an agent in accordance with the nature of the issues in dispute and the complexity of the claim, and the ability of the staff member and/or agent to act in a lawful manner and with the requisite level of skill and competence.

3.4 The insurer, including all staff and agents, will comply with claim handling obligations under the Act, the Regulation, these Guidelines, other guidelines of the Authority including the Medical Assessment Guidelines and Claims Assessment Guidelines, the NSW Government Model Litigant Policy for Civil Litigation and other applicable laws, instruments and directions.

3.5 The insurer will have systems in place to monitor the conduct and compliance with obligations of claims staff and agents.

3.6 The insurer will have systems in place to ensure that claims staff and agents who handle claims do so in accordance with the requirements of the Australian Privacy Principles, The Privacy and Personal Information Protection Act 1998 and the Health Records and Information Privacy Act 2002.

3.7 The insurer will remedy non-compliance with claim handling obligations as quickly as possible upon the non-compliance being discovered, advised or disclosed.

Principle 4: The insurer will act on each claim in a manner that promotes the integrity of the claim

General conduct standards

4.1 The insurer will verify the identity of each person making a claim for compensation.

4.2 The insurer will obtain all reasonably necessary documentation to undertake an assessment of the claim to evaluate the validity of the claim, including an assessment of whether any part of the claim may be fraudulent and record the findings of the assessment.

4.3 The insurer will have systems in place to enable the identification, further investigation and management of claims reasonably suspected of being fraudulent.

4.4 The insurer will provide claims staff and agents with the necessary training and resources to discharge obligations in this principle 4, under clauses 4.1 to 4.5 inclusive.

4.5 Upon request of the Authority the insurer will report in a manner approved by the Authority on matters outlined in standards outlined in clauses 4.1 to 4.4.

Principle 5: The insurer will keep the injured person informed at all times of the status and progress of the claim

General conduct standards

5.1 The insurer will communicate in a timely manner with respect and courtesy, in plain language and in a manner that is accurate, complete and concise and tailored to the recipient.

5.2 The insurer will provide an injured person or their legal representative with sufficient information to enable the injured person or their legal representative to discern the insurer’s position on the current status of the claim and identify appropriate next steps in the progress of the claim.

5.3 The insurer will advise an injured person who is not legally represented in writing, as soon as possible, of:

- 5.3.1 the insurer’s position (and any changes to that position), on the factual circumstances of the accident, the nature and extent of the injuries sustained by the injured person (including their treatment, rehabilitation and care needs) and any entitlement to damages

- 5.3.2 the next steps required to progress the resolution of the claim, the expected timeframe for each step and the responsibilities of the parties in regard to each step

- 5.3.3 the impending expiration of any time limit associated with a step in the claim process and the action required by the injured person to complete the step as soon as possible but not less than 20 days before the expiration of the time limit.

5.4. The insurer will communicate in writing the nature and status of payments made to or on behalf of the injured person, before liability is admitted on a claim, or where liability is wholly denied.

5.5 The insurer will provide information about the scheme, as may be required or directed by the Authority.

Part B: Specific requirements

6.0 Accident notification form (ANF)

Insurers should manage an ANF in accordance with the overarching principles. Anyone injured in a motor vehicle accident in NSW may be able to access the benefits available under the ANF, regardless of fault.

The aims of the ANF provisions are to provide early payment for reasonable and necessary medical expenses and/or lost earnings. Insurers should therefore exercise any discretion in relation to the payment of ANF benefits by reference to the principles; in particular, acting proactively to optimise an injured person’s recovery from injuries.

Specific requirements

6.1 The insurer will advise the injured person that an ANF is a claim for treatment expenses and lost earnings only and that a claim form should be lodged within six months of the date of the accident if the injured person wants to claim compensation for damages other than treatment expenses and lost earnings covered by the ANF.

6.2 The insurer in receipt of a validly lodged ANF will admit provisional liability in any circumstance where its insured vehicle was involved in the accident, irrespective of fault.

6.3 Where the injured person has lodged multiple ANFs with more than one insurer with respect to the one motor vehicle accident, the insurers involved will ensure that the injured person is not disadvantaged while they decide which insurer will handle the claim. The insurers involved will promptly decide which insurer will manage the claim and the managing insurer will then communicate this decision to the injured person within 24 hours of that decision being made.

6.4 The insurer will advise the injured person in writing when they are nearing the dollar limit of the ANF or a point in time, at least 20 days before the expiration of six months after the motor accident, and advise them that a claim form should be lodged within six months of the date of the accident if the injured person wants to claim compensation for damages other than treatment expenses and lost earnings covered by the ANF.

7.0 Nominal defendant – due inquiry and search

The specific requirements for insurers in relation to handling nominal defendant claims must be read in conjunction with the legislation and the overarching principles. Of particular relevance is the principle that an insurer will always act to resolve the claim justly and expeditiously.

In the context of due inquiry and search, this entails making decisions based on all the available information and documentation, consistent with the facts and in accordance with the law, as well as providing the injured person with sufficiently detailed written reasons.

Specific requirements

7.1 The insurer managing a nominal defendant claim will, in respect of a vehicle that is unidentified, explain to the injured person in writing of the requirement for the injured person to make due inquiry and search to ascertain the identity of the vehicle alleged to have been at fault in the accident.

7.2 The insurer will promptly advise the injured person in writing whether or not the injured person has, in the insurer’s view, satisfied the requirement for due inquiry and search.

7.2.1 Where the insurer alleges that the requirement has not been met, the insurer must include in the reasons for its decision details of the deficiency and manner by which the requirement could be satisfied by the injured person.

7.2.2 The insurer will include with its advice reasons why it considers that an injured person has not satisfied due inquiry and search in accordance with the requirements of standard outlined in clause 1.3.

8.0 Late claims

In responding to issues involving late claims, insurers will adhere to the overarching principles, in particular, acting to resolve the claim justly and expeditiously.

When exercising discretion in relation to late claims, insurers will need to weigh up whether to take issue with same by reference to general conduct standards such as acting with proportionality and paying claims without relying on technical defences or minor procedural defects or irregularities.

Specific requirements

8.1 If the insurer takes action on the late lodgement, it will request a full and satisfactory explanation as soon as possible, after receiving the claim.

8.2 Upon receipt of the injured person’s explanation for lodging a late claim, the insurer will write to the injured person as soon as possible, if it does not accept that the explanation is full and satisfactory for the delay and detail the reasons for its decision.

8.3 If an insurer does not accept an explanation for a late claim, the insurer in its reasons will advise the injured person of the grounds upon which it does not consider the explanation to be full or satisfactory or both.

8.4 The insurer will not delay its investigation of each of the elements of liability on the basis that the claim is lodged late.

9.0 Liability notices

An insurer’s decision with respect to liability is one of the critical events in claims handling which impacts the injured person’s rights and entitlements. As such, the overarching principles apply to all aspects of liability determination and the communication of liability decisions.

The specific requirements with respect to liability notices outline the claims handling processes and procedures to be followed; however, the overriding imperative is that Insurers should always act in accordance with the principles.

Specific requirements

9.1 The insurer must give written notice to the injured person indicating whether the insurer admits or denies liability for the claim as expeditiously as possible, and within three months of the date the claim form is received by the insurer (or by the Authority in the case of claims made against the nominal defendant).

9.2 Where liability is not wholly admitted, the notice must give sufficient detail to the injured person to enable the injured person to understand the extent to which liability, and each of the elements of liability, are admitted, and must refer to the reasons for that decision and the nature and source of the evidence that supports those reasons.

9.2.1 If liability is denied, the insurer will provide reasons why liability is denied and the nature and source of the evidence that supports those reasons.

9.3 If the notice indicates that the insurer is making an allegation of contributory negligence, then the insurer must advise the injured person in writing of the degree of contributory negligence it says can be attributed to the injured person, and provide the reasons for that decision and the nature and source of the evidence that supports the degree of contributory negligence alleged.

9.4 If the notice indicates that causation of injury is a reason for not wholly admitting liability, then the insurer must advise the injured person in writing of the injury or injuries the insurer says were not caused by the accident and refer to the reasons for that decision and the nature and source of the evidence that supports it.

9.5 A letter that gives notice of the admission or denial of liability within three months in accordance with section 81 and these Guidelines must be clearly identified as a Section 81(1) Notice.

9.6 Where the insurer does not wholly admit liability for the claim in accordance with section 81 and these Guidelines, and subsequently receives information that warrants an admission of liability or reduction in the degree of contributory negligence alleged, the insurer will advise the injured person in writing as soon as possible but within 10 days of receipt of the additional information.

10.0 Investigations

In accordance with the principles that the insurer will always act to resolve the claim justly and expeditiously and will act on each claim in a manner that promotes the integrity of the claim, it is imperative that prompt and thorough investigations are carried out.

The insurer should always consider whether investigations are required in the first instance, and if so, ensure that such investigations are appropriate with respect to the issues arising in the claim.

A medical examination can be a stressful experience for an injured person; a joint assessment may assist in minimising disputes and expediting a claim towards finalisation. Insurers and insurers’ agents handling claims should also note that their appointed investigators and medico-legal experts are expected to abide by these Guidelines.

Specific requirements

10.1 The insurer will promptly investigate liability and quantum for a claim by requesting information and documents about the claim in a timely manner, and regularly following up any requests.

10.2 The insurer will consider the different evidential value and weight of the information it obtains during the course of its investigations and will give greater value and weight to information obtained from the injured person’s treating medical, health or rehabilitation provider, unless it is unreasonable in the circumstances to do so.

Medical investigation and examinations

10.3 The insurer will request documents from the injured person’s treating medical, rehabilitation and health service providers promptly and will provide copies of all documents so obtained to the injured person as soon as possible (within 20 days of receipt) unless the treating medical, rehabilitation or health service provider indicates otherwise.

10.4 Where an independent health service provider examination will assist in the just and expeditious resolution of the claim the insurer will promptly attend to the arrangement of the examination, unless the injured person has retained legal representation.

10.5 Where an injured person has retained legal representation, the insurer will firstly make a request for joint medical examination of the injured person:

10.5.1 The insurer will nominate three suitably qualified independent health service providers. Alternatively, the injured person may nominate a list of three suitably qualified independent health service providers and the insurer will respond with its choice of expert promptly (within 10 days).

10.5.2 The costs of the joint medical examination will be met by the insurer.

10.6 If agreement cannot be reached regarding a joint medical examination, the insurer may appoint its own independent health service provider, however the insurer may only appoint one independent health service provider in any specialty (unless there are exceptional circumstances).

10.6.1 The insurer will provide to the injured person any independent health service provider’s report unless it withholds the provision of the report on the grounds of privilege.

10.7 The insurer will keep to a minimum the number of independent health service provider examinations (including joint medical examinations and refresher examinations) it requires an injured person to attend.

10.8 If a medical dispute as defined under section 57 of the Act arises, the insurer will refer it to the MAS in accordance with the Authority’s Medical Assessment Guidelines.

Surveillance investigations

10.9 The insurer will conduct surveillance of the injured person only when there is evidence to indicate that the injured person is exaggerating an aspect of the claim or providing misleading information or documents in relation to a claim or where the insurer reasonably believes that the claim is inconsistent with information or documents in the insurer’s possession regarding the circumstances of the accident or medical evidence.

10.10 The insurer will only conduct surveillance in places regarded as public or where the injured person, whilst on private property, is observable by members of the public going about their ordinary daily activities.

10.11 The investigator acting on behalf of the insurer must not actively interfere with the injured person’s activities whilst under observation or interact with them so as to have an impact on their activities.

10.12 The insurer or investigator acting on behalf of the insurer will not engage in any acts of inducement, entrapment or trespass when carrying out factual investigations and/or surveillance activities. Inducement or entrapment can include social media activities such as sending ‘friend’ requests with the intention to induce, entrap or deceive.

10.13 The insurer will be sensitive to the privacy rights of children, and take reasonable action to avoid unnecessary video surveillance of children, and where possible hide images of children in reports which contain still photographs of children.

10.14 The insurer will take reasonable action to avoid unnecessary video surveillance of children when undertaking surveillance of an injured person. In requirements 10.13 and 10.14 ‘children’ means persons who are under the age of 18 years.

10.15 Where the insurer sends surveillance material to a third party, it will inform that party about confidentiality and relevant privacy obligations.

11.0 Communication with injured people and their representatives

The overarching principles apply to insurers in all aspects of communication when handling claims. The specific conduct rules outlined below recognise that an injured person may engage a legal representative to deal with the insurer on their behalf and may also choose how much direct communication they will have with the insurer.

The specific conduct rules permit an insurer to make contact with the injured person only in specific circumstances detailed in the part in order to progress the claim expeditiously to resolution.

Specific requirements

11.1 If an injured person is legally represented, the insurer will direct all requests for documents or advice to the injured person’s legal representative, unless otherwise directed by the injured person. In 11.2 and 11.3 below, the definition of injured person means the injured person only and not the injured person’s legal representative.

11.2 If an injured person is legally represented the insurer may:

11.2.1 send generic information about making and resolving claims directly to an injured person, and a copy must also be sent to the injured person’s legal representative

11.2.2 contact the injured person directly:

11.2.2.1 if requested to do so by the injured person

11.2.2.2 if there is no substantive reply by the injured person’s legal representative to the insurer’s offer of settlement within 10 days and an attempt has been made by the insurer to confirm the receipt of the settlement offer

11.2.2.3 if there is no substantive reply by the injured person’s legal representative to the insurer’s correspondence (excluding offer(s) of settlement) within 20 days, and an attempt has been made by the insurer to confirm the receipt of the correspondence

11.2.2.4 to advise the injured person, in addition to the injured person’s legal representative, about the details of a medical appointment arranged by the insurer

11.2.2.5 in response to a complaint notified to the insurer by the injured person.

11.3 An insurer may contact the injured person directly about their rehabilitation, however the insurer will advise the injured person’s legal representative of intended communications before the first communication.

12.0 Medical Guidelines for treatment, rehabilitation and attendant care services and payments

The specific requirements in relation to treatment, rehabilitation and attendant care (TRAC) services and payments set out minimum process standards and timeframes. An insurer should aim to improve upon these service levels based upon the principle that the insurer will handle the claim proactively to support the injured person to optimise their recovery, through early and appropriate treatment and rehabilitation.

An insurer should also maintain a consistent approach and process when making decisions about reasonable and necessary treatment.

Specific requirements

12.1 The insurer will conduct an initial treatment, rehabilitation and attendant care needs assessment of an injured person as soon as possible (within 10 days of receiving a claim).

12.2 With the agreement of the injured person, an injured person who has been identified as requiring treatment, rehabilitation and attendant care services must be referred to an appropriate treatment provider (including vocational provider, if appropriate) as soon as possible (within 10 days of the identification).

Approving requests

12.3 Where the insurer approves payment of the injured person’s treatment, rehabilitation and attendant care expenses, it will:

12.3.1 advise the injured person, their legal representative and service provider in writing as soon as possible but within 10 days of receipt of a plan or request

12.3.2 state the costs the insurer has agreed to meet

12.3.3 pay the account as soon as possible but within 20 days of receipt of an invoice or expense.

12.4 The insurer will advise the injured person of the insurer’s obligation to pay, and make payment of, all reasonable and necessary costs and expenses, including travel expenses to attend treatment, rehabilitation services or assessments and for attendance at an independent health service provider examination arranged by the insurer, joint medical examination or an assessment by MAS as soon as possible (no later than 20 days of receipt of the account or request for reimbursement).

Declining requests

12.5 Before declining, in full or in part, a request for payment of treatment, rehabilitation and attendant care services, the insurer will consider whether the documents held on the claim file are sufficient to make the decision. Where the documents held are insufficient, the insurer will request additional documents from the injured person, or their treatment provider, if the documents may assist in the insurer’s decision.

12.6 When the insurer declines or partially declines to pay for the injured person’s treatment, rehabilitation and attendant care expenses, it will:

12.6.1 as soon as possible (no later than 10 days of receipt of a plan, request or claim for expenses incurred) provide feedback to the injured person and their treatment provider

12.6.2 as soon as possible (within 10 days of receipt of a plan, request or expense) advise the injured person, their legal representative and treatment provider in writing, clearly explaining the reasons why the insurer considers the plan, request or expense not to be reasonable and/or necessary, not properly verified or not related to the accident (this may include copies of medical reports on which the decision is based)

12.6.3 provide the injured person with a written response including a copy of the insurer’s internal complaint and review procedure, and any documents issued by the Authority regarding the resolution of medical disputes in relation to the provision of or payment of, treatment and/or rehabilitation, unless previously provided.

12.7 Where the insurer decides to terminate or vary previously approved treatment, rehabilitation and attendant care services (for reasons other than settlement) it will firstly discuss the decision with the injured person and the treatment provider and will then advise the injured person and the treatment provider in writing:

12.7.1 as soon as possible (at least five days before the effective date of the decision to terminate or vary treatment and rehabilitation)

12.7.2 as soon as possible (at least 10 days before the effective date of the decision to terminate or vary attendant care programs)

12.7.3 include reasons for the decision clearly outlining why the insurer terminated payment, including copies of any documents on which the decision was based, where appropriate

12.7.4 provide the injured person with a copy of the insurer’s internal complaint and review procedure and the Authority’s brochure ‘Resolving medical disputes’, unless previously provided.

12.8 Where the insurer decides to terminate previously approved treatment, rehabilitation and attendant care services it will first discuss termination with the treatment provider where sudden cessation of treatment, rehabilitation or attendant care places the injured person at significant risk (for example, during a course of psychological treatment, removal of equipment or a specific service).

Avoidance of delay in provision of treatment, rehabilitation and attendant care services

12.9 To optimise an injured person’s recovery, the insurer may use a range of claim handling practices tailored to the needs of the injured person, such as the use of pre-approval procedures and without prejudice payments to avoid delays or interruptions in the provision of treatment, rehabilitation and attendant care services.

12.10 Where there is another third party involved in the assessment and provision of the injured person’s treatment, rehabilitation and attendant care needs (such as the Lifetime Care and Support Authority), the insurer will co-operate with that third party to ensure that the injured person’s treatment, rehabilitation and attendant care services are not unduly delayed by:

12.10.1 providing treating medical information to the third party, as soon as possible (within 20 days of receipt)

12.10.2 promptly arranging independent health service providers examinations, where the insurer intends to rely upon the information (such as, regarding whether the injured person is eligible for the Lifetime Care and Support Scheme).

12.11 The introductory paragraph to specific requirements 12.1 to 12.10.2 inclusive are issued under section 44 of the Act.

13.0 Financial hardship: insurer’s duty under section 84A

In responding to requests for an interim payment, insurers should act justly and expeditiously in all aspects of claims handling. With respect to interim payment requests, acting with proportionality means that insurers should bear in mind the cost and delay incurred in asking the injured person to provide unnecessarily onerous and irrelevant documentation.

Where the interim payment request is for a modest sum, for example, insurers should limit their requests to documents that are readily available and not unduly intrusive, bearing in mind that the duty is to avoid the injured person suffering financial hardship.

14.0 Non-economic loss

As the entitlement to non-economic loss can be a critical issue impacting the assessment of quantum, and is often the subject of disputation, in addition to these specific requirements, insurers should always act consistently with the overarching principles.

Of particular note here is the standard outlined in clause 1.3 which requires the insurer to make decisions based on all the available documents, consistent with the facts and in accordance with the law. For example, conceding an entitlement to non-economic loss when the insurer is in possession of independent health service provider examination reports that indicate that an injured person’s whole person impairment is greater than 10 per cent.

Specific requirements

14.1 The insurer will clearly indicate to the injured person, regardless of whether or not an injured person claims to be entitled to non-economic loss, that:

14.1.1 the insurer has determined whether or not the injured person is or is not entitled to non-economic loss, or

14.1.2 when an injured person claims to be entitled to non-economic loss but the insurer disagrees, the insurer will clearly explain the reasons and detail any medical information considered in the course of making its decision that the injured person’s degree of permanent impairment is not greater than 10 per cent

14.1.3 the explanation must be sufficient to enable the injured person to make an informed decision about whether to accept the insurer’s decision or to seek an independent binding medical assessment of impairment by MAS. The insurer will provide a copy of the Authority’s brochure ‘Resolving permanent impairment disputes’ to an injured person who is not legally represented

14.1.4 where an injured person has sufficiently recovered to enable the claim to be quantified, and the insurer is unable to determine whether the injured person’s degree of permanent impairment is greater than 10 per cent, the insurer will refer the matter to MAS for assessment.

15.0 Reasonable offers of settlement and finalising claims

In addition to the specific requirements with respect to reasonable offers of settlement and finalising claims, insurers should first and foremost apply the principles. In acting to resolve the claim justly and expeditiously, insurers should continually review and identify whether the injured person is sufficiently recovered to enable quantification of the claim, and if so, make a reasonable offer of settlement.

A reasonable offer is one that is reflective of the injuries and the losses the injured person has suffered as a consequence of the motor vehicle accident.

Specific requirements

15.1 The insurer will:

- 15.1.1 make a reasonable offer of settlement to the injured person as required by the duty imposed on it under section 82 of the Act, unless the insurer wholly denies liability for the claim

- 15.1.2 provide the injured person with a full list of paid and unpaid expenses on the claim file, at the time of making an offer of settlement and at least 24 hours before attending a settlement conference, CARS Assessment or court hearing.

Insurer’s first offer of settlement

15.2 The insurer’s reasonable range for each head of damage applicable to the insurer’s first offer of settlement must be recorded on the claim file.

15.3 The insurer’s first offer of settlement will:

- 15.3.1 be set out in writing to the injured person (if not legally represented) or the injured person’s legal representative

- 15.3.2 list amounts (including zero) offered for each head of damage that could arise from a claim of the nature made by the injured person, and include all relevant calculations

- 15.3.3 where applicable, identify as a separate amount any allowance for the injured person’s legal costs and disbursements

- 15.3.4 where applicable, identify any deductions that have been made or are likely to be made and how they have been determined or calculated

- 15.3.5 include a reference to the insurer’s duty under section 82 of the Act, if the offer is made under that section.

Compensation amount agreed with the injured person

15.4 When the claim settles, the amount of the compensation to be paid to the injured person is to be broken down by the insurer into the amount for each head of damage including any relevant calculations, an assessment for the injured person’s legal costs and disbursements, and any applicable deductions.

15.5 Where an injured person is not legally represented, the amount of any settlement agreed with the injured person, including the breakdown referred to in requirement 15.4 is to be confirmed in writing.

15.6 The insurer is to make an accurate record on the Personal Injury Register (PIR) and the claim file of the settlement amount, including the amount for each head of damage, an assessment for the injured person’s legal costs and disbursements and any applicable deductions.

16.0 Complaints, reviews and disputes handling

In responding to complaints, reviews and disputes, insurers will adhere to all of the overarching principles. A robust complaint handling process provides the injured people with confidence they are heard, their feedback is taken seriously and that insurers are accountable for their actions.

Specific requirements

16.1 The insurer must have a documented internal complaint and review procedure, the terms of which must be set out in the insurer’s business plan.

16.2 An insurer who receives a complaint, request for review or dispute (whether verbal or in writing) must handle it in accordance with the documented procedure.

16.3 The insurer’s complaint and review procedure must be readily accessible to the public, including publication on the insurer’s website, and provided upon request.

16.4 At a minimum an insurer is required to:

- 16.4.1 acknowledge a complaint, request for review or dispute in writing and provide the person with a copy of the insurer’s procedures and the details of the representative of the insurer handling the complaint, review or dispute as soon as possible but within five days from the receipt of the complaint or dispute

- 16.4.2 provide the person with the opportunity of having the complaint, review or dispute considered by a more senior representative of the insurer independent of the original decision maker, and

- 16.4.3 provide written reasons for a decision in relation to the complaint, review or dispute and information on the availability of external complaint or dispute resolution handling bodies (including the Authority, MAS and CARS) in the event that the person is dissatisfied with the insurer’s decision or procedures.

16.5 The insurer will keep a copy of complaints, review requests and disputes on the relevant claim file(s), including its response and written reasons and will provide data on complaints, review requests and disputes including this information to the Authority, in the manner requested, from time to time.

16.6 The insurer will co-operate fully with the Authority, including CARS and MAS, in respect of any complaint, review request or dispute.

17.0 Information and data integrity

Information and data integrity is critical to the scheme and to demonstrating insurer performance. Accurate and complete information promotes the credibility and accountability of the scheme and those operating within it.

Specific requirements

17.1 At the direction of the Authority, an insurer will provide timely, accurate and complete information, including but not limited to:

- 17.1.1 insurer claims manuals, policies and procedure documents including updates as they occur

- 17.1.2 injured person information packs/brochures

- 17.1.3 standard letter templates

- 17.1.4 self-audit results, including quality assurance (QA) reporting

- 17.1.5 complaints received by the insurer about its handling of claims

- 17.1.6 injured person survey results

- 17.1.7 training plans and logs, and/ or data breaches that affect the privacy of the injured person or their family.

17.2 An insurer will:

- 17.2.1 code the injured person’s injuries by using appropriately trained coders applying the Abbreviated Injury Scale (AIS) 2005 Revision (or as otherwise prescribed by the Authority) to ANFs and claims in accordance with SIRA’s Motor Accident Insurance Regulation Injury Coding Guidelines and agreed time frames;

- 17.2.2 provide up to date and accurate claims data to the Motor Accidents Claims Register, in accordance with section 120 of the Act and the Claims Register (PIR) Coding Manual, as amended, or as otherwise required by the Authority, and

- 17.2.3 maintain consistency between information on the claim file and data submitted to the Claims Register, and record any changes in accordance with the Claims Register (PIR) Coding Manual, as amended.

18.0 Insurer business plans

A business plan describes the manner in which the insurer conducts its claims handling operations. It includes detailed information on how the insurer will ensure that its claims operations are consistent with these Guidelines, and in particular how it will satisfy the principles, standards and requirements.

Specific requirements

18.1 Upon a request of the Authority under section 173 of the Act an insurer must prepare a business plan.

18.2 The insurer’s business plan may, at the direction of the Authority, include such information as:

- 18.2.1 details of the insurer’s claims handling operations

- 18.2.2 how the insurer (and its agents) will comply with the Act, principles, standards and requirements in the Guidelines

- 18.2.3 performance targets

- 18.2.4 information regarding how the insurer will monitor and measure adherence (including that of any agent of the insurer) to the Guidelines

- 18.2.5 details of the insurer’s claims handling expenses

- 18.2.6 systems in place to support compliance

18.3 Requirements 18.1 to 18.2.6 inclusive are issued under section 173(4) of the Act.

Issued 1 January 2017