Print PDF

Review of the Nominal Insurer: discussion paper

This discussion paper relates to a SIRA consultation. A pdf version is also available.

Executive Summary

This discussion paper is about the performance of the Workers Compensation Nominal Insurer (Nominal Insurer) managed by icare and the work undertaken on its behalf by its agents (EML, Allianz and GIO).

Workers compensation is a necessary support system as it provides confidence to the people of NSW that they will be looked after. Employers are assured that they can access affordable and effective cover while workers take comfort that personal support will be provided should they sustain a work-related injury.

The NSW workers compensation system is the largest defined benefit scheme in Australia. It protects over 4.5 million workers with approximately 90,000 active claims from injured workers being managed each year.

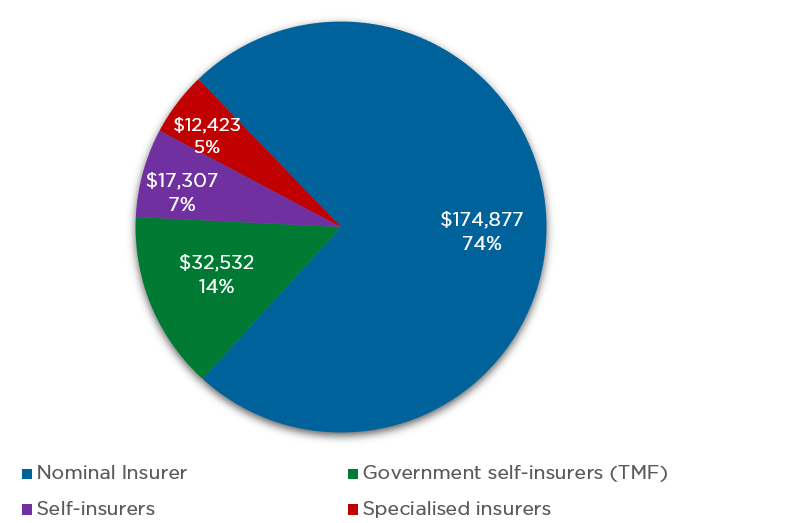

Within this essential infrastructure, the Nominal Insurer, managed by Insurance and Care NSW (icare) and known as icare workers insurance, is the largest insurer. The Nominal Insurer issues 74% of total premiums1 with its agents EML, Allianz and GIO managing 65% of total active claims2.

Given its dominance within the NSW market, the success of the Nominal Insurer is critical to the success of the NSW workers compensation system.

The State Insurance Regulatory Authority (SIRA) has commissioned the Compliance and Performance Review of the Workers Compensation Nominal Insurer Scheme (the Review). The Review seeks to assess and address matters identified through SIRA’s regulatory activities. It is imperative given the materiality of the Nominal Insurer’s performance on the overall performance of the workers compensation system and SIRA’s responsibilities as regulator of that system.

This discussion paper provides an overview of the matters being considered by the Review and provides further information on the Nominal Insurer and the icare operating structure to assist you in making a submission.

Submissions to the Review from employers, workers, insurers and other interested parties are sought to ensure confidence is maintained in the NSW workers compensation system and that employers and workers are treated fairly.

Background to the Review

State Insurance Regulatory Authority

The State Insurance Regulatory Authority (SIRA) was established under the State Insurance and Care Governance Act 2015 (SICG Act) to regulate the government’s insurance schemes including workers compensation insurance. SIRA undertakes system-wide stewardship to make sure the state’s insurance and support systems deliver confidence through affordable protection and wellbeing through recovery and restoration.

The government’s intent in establishing SIRA was outlined in the NSW Parliament in 2015.

SIRA will focus on ensuring that key public policy outcomes are being achieved in relation to service delivery to injured people, affordability, and the effective management and sustainability of the insurance schemes. Consolidating regulatory responsibility for State insurance into one regulator will enable a consistent and robust approach to the monitoring and enforcement of insurance and compensation legislation in this State.3

The Review

During 2018, SIRA closely monitored and considered analysis of aspects of the compliance and performance of the Nominal Insurer scheme, including trends in liability valuations and costs, premium setting, operational reforms and risk management, return to work rates, data quality, customer complaints and concerns raised by business representatives, unions and other stakeholders.

SIRA commissioned the compliance and performance Review in February 2019.

The Review is being undertaken for SIRA by an Independent Reviewer, Ms Janet Dore and supported by SIRA’s independent scheme actuaries, Ernst & Young and authorised officers of SIRA.

The Review is an integrated compliance and performance review including:

- Independent Reviewer stakeholder meetings with insurer, employer and worker groups

- an audit of compliance with legislation and relevant guidelines including the Market Practice and Premiums Guidelines (MPPGs) led by the Independent Actuaries

- a performance review in relation to claims management, return to work outcomes and other objectives and requirements under the legislation by the Independent Actuaries, and

- this public consultation.

A final report outlining the findings of the Review is expected to be provided to SIRA by August 2019 and released later this year.

Terms of reference

The terms of reference for the Review are to consult with stakeholders and undertake analysis of data to provide findings in relation to the Nominal Insurer’s compliance and performance, in particular to:

- assess Nominal Insurer compliance with SIRA’s Market Practice and Premium Guidelines (MPPGs) and identify any unintended consequences, risks and priorities for improvement in SIRA regulation of the premiums of the Nominal Insurer

- identify the benefits and risks to the performance of the NSW workers compensation system arising from icare’s implementation changes to the Nominal Insurer operating model and supporting digital platforms

- assess the Nominal Insurer’s performance in relation to return to work outcomes, claims management (including guidance, support and services for workers, employers and health service providers), customer experience and data quality and reporting.

How to make a submission

SIRA has released this discussion paper to provide an opportunity for individuals and organisations to contribute to the Review by sharing their views, experiences and insights of the Nominal Insurer’s performance and its agents EML, Allianz and GIO. It contains:

- information about the Nominal Insurer and icare operating structure

- matters on which SIRA is seeking comment and information.

SIRA is seeking comments on issues which are considered relevant to the Review. We encourage you to attach any evidence that will support your feedback and provide specific examples where possible.

This discussion paper is not calling for current and unresolved individual complaints regarding your policy or claim.

Please contact SIRA on 13 10 50 if:

- you are an employer, insurer or other stakeholder with an unresolved enquiry or a complaint

- you are a worker with a current complaint about your employer or provider (i.e. treatment provider)

Please contact the Workers Compensation Independent Review Office on 13 94 76 if:

- you are a worker (or their representative) with an unresolved enquiry

- you are a worker with a current complaint about an insurer.

Submissions received as part of the Review may be published on the SIRA website. If you do not wish to have your submission published, please state this on your submission.

Key dates

The key dates of the Review are provided below:

Discussion paper stages | Key dates |

|---|---|

Public consultation closes | 14 June 2019 |

Independent Reviewer’s report presented to SIRA | August 2019 |

Independent Reviewer’s report published | Late 2019 |

Workers compensation system

Objectives of the workers compensation system

The objectives of the NSW workers compensation system are set out in section 3 of the Workplace Injury Management and Workers Compensation Act 1998 (1998 Act). These are to:

- secure worker health, safety and welfare while preventing work related injury

- provide prompt treatment and rehabilitation to assist injured workers to return to work

- provide income and treatment payments to injured workers and their families

- provide a fair, affordable and financially viable system

- ensure contributions by employers are commensurate with risks, taking into account strategies and performance in injury prevention, injury management and return to work

- deliver an efficient and effective system.

The NSW workers compensation system operates under three Acts, the Workers Compensation Act 1987 (1987 Act), the Workplace Injury Management and Workers Compensation Action 1998 (1998 Act) and the State Insurance Care Governance Act 2015 (SICG Act).

Customer expectations

Community expectations often exceed what the legislation requires. Within the financial services industry, insurers are expected to lead a corporate culture that has at its centre the best interests of customers to treat them fairly at all times.

SIRA takes seriously its obligations to hold insurers accountable for the services, experience and outcomes for workers, employers and citizens, for whom the workers compensation system in NSW exists.

Insurers within the workers compensation system

The NSW workers compensation system is the largest defined benefit system in Australia. The system includes the following insurance segments:

- Nominal Insurer: the statutory insurer responsible for the workers compensation Insurance Fund (managed by icare amd known as workers insurance)

- Specialised insurers: there are currently six insurers licensed to operate within particular industries

- Self-insurers: there are currently 59 large employers licensed to self-insure

- Government self-insurers: employers covered by the Government’s managed fund scheme the Treasury Managed Fund.

Figure 1: Total reported NSW wages ($ million and percentage) by insurer segment for 2016/174

Nominal Insurer and icare

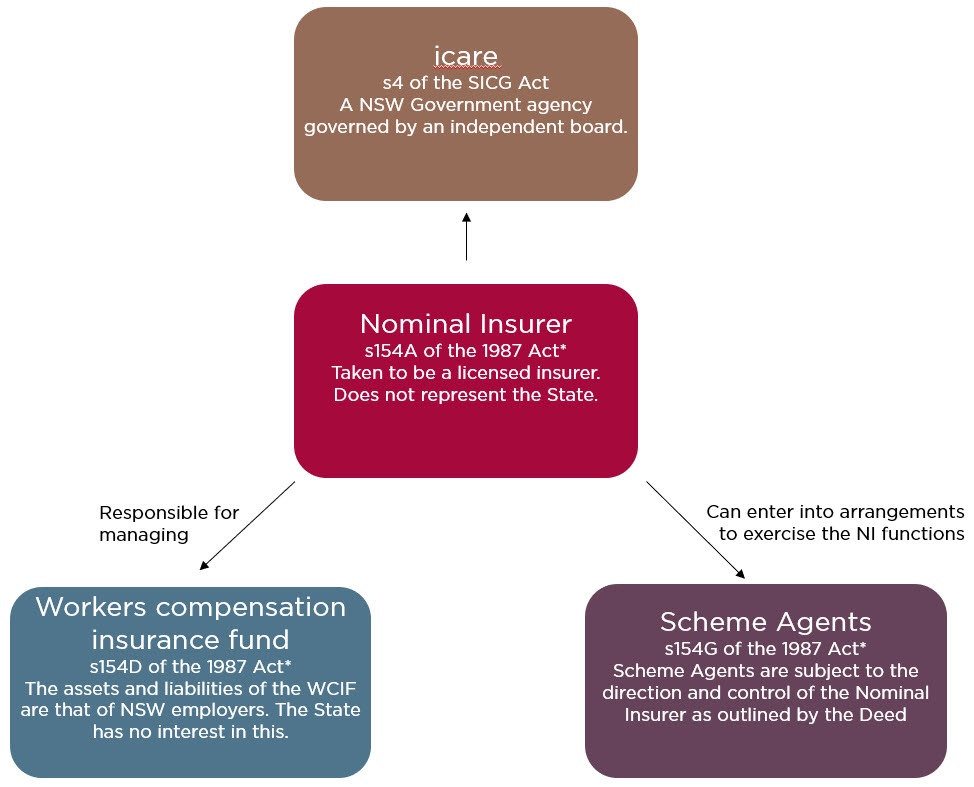

Nominal Insurer

The Workers Compensation Nominal Insurer (Nominal Insurer) managed by Insurance and Care NSW (icare) is the largest insurer in the workers compensation system in NSW, accounting for approximately 65% of total active claims. The Nominal Insurer provides worker compensation cover for more than 320,000 employers and manages approximately 65,000 new claims each year. It collects $2.3 billion in premiums and pays $1.97 billion in claim-related costs.

The Nominal Insurer has a unique statutory, governance and regulatory structure. It is established under Division 1A Part 7 of the 1987 Act with an unconditional licence to issue policies of insurance to NSW employers (section 154B(1) 1987 Act). It does not require an authorisation under the Commonwealth Insurance Act 1973 to operate and is not regulated by the Australian Prudential Regulation Authority.

The Nominal Insurer was created as part of the 2003 workers compensation reforms to introduce greater competition into the workers compensation system by enabling businesses other than insurance companies to provide workers compensation services by contracting with the Nominal Insurer5. Subsequent to the reforms, the Nominal Insurer contracted with these parties and insurers as scheme agents. The WorkCover Authority of NSW acted for the Nominal Insurer and oversaw the management of the Nominal Insurer scheme.

icare

The structural reforms under the SICG Act commenced on 1 September 2015 dissolving the WorkCover Authority of NSW and establishing SIRA, icare, and the workplace safety regulator, SafeWork NSW.

icare operates as a public financial corporation governed by an independent board of directors. It is required to report separately to the NSW Treasurer and has obligations to the NSW Government as a commercial government business.

The government’s intent in establishing icare was outlined in the NSW Parliament in 2015.

Insurance and Care NSW will be a centre of excellence for long-term care needs, combining claim cohorts with similar care needs to focus on return to work and quality of life outcomes. Insurance and Care NSW will deliver workers compensation that is less adversarial. There will be fewer forms and less bureaucracy, and injured workers will have more say in their treatment and return-to-work pathway.6

icare is responsible for administering the Nominal Insurer, but does not own and is not legally responsible for, the financial liabilities of the Nominal Insurer as this ultimately resides with the employers of NSW, as explained below.

Workers Compensation Insurance Fund

The Workers Compensation Insurance Fund is administered by the Nominal Insurer and its assets are subject to a statutory trust for the benefit of workers and employers (section 154D(2) 1987 Act). While employers do not control the management of the fund, they potentially carry the financial burden of the scheme (as fund shortfalls are passed onto NSW employers through higher premiums).

Figure 2: Nominal Insurer legal structure

Workers compensation premiums

Regulatory requirements

Since 2015, Nominal Insurer premiums have moved from being set through the Government Insurance Premium Order to a principles-based file-and-write system under SIRA’s Market Practice and Premiums Guidelines (MPPGs).

The principles are:

- Principle 1: Premiums are fair and reflective of risk

- Principle 2: Balance between risk pooling and individual employer experience

- Principle 3: Premiums should not be unreasonably volatile or excessive

- Principle 4: Incentives for risk management and good claims outcomes

- Principle 5: The premium basis needs to be consistent with the insurer’s capital requirements.

These Principles are supported by specific requirements, for example for 2017/2018 policies, under Clause 6.12 of the MPPGs:

Where an insured employer is subject to being experience rated in accordance with section 6.7 of this Guideline, licensed insurers must ensure that the employer’s premium rate does not increase by more than 30 per cent from the previous policy year due to the employer’s own claim experience or due to amendments to an insurer’s premium methodology.

Nominal Insurer premiums operating structure

In August 2016, icare announced it would insource the Nominal Insurer’s underwriting functions by directly undertaking the policy and billing requirements in-house from early 2017. The changes encompassed a new broker channel, a self-service portal and a customer support centre6.

The underwriting functions were previously undertaken by Allianz Australia Workers’ Compensation (NSW) (Allianz), CGU Workers’ Compensation (NSW) (CGU), Employers Mutual NSW (EML), GIO and QBE Workers’ Compensation (NSW) (QBE).

These changes to inhouse the underwriting functions were implemented by icare in April 2017.

Premiums questions

1.1 Please rate your experience with workers compensation premiums issued by the Nominal Insurer (icare) from 5 (excellent) to 1 (poor).

1.2 What has been your experience with workers compensation premiums issued by the Nominal Insurer (icare)?

1.3 What should the Nominal Insurer (icare) be doing more of?

1.4 What should the Nominal Insurer (icare) be doing less of?

1.5 Are there any improvements you would like to suggest regarding premiums?

Workers compensation claims management

Statutory claims management

Benefits and entitlements under the NSW workers compensation system are prescribed by the workers compensation legislative framework. This Review is not considering the merits of legislation and regulation. It is focused on delivery of those benefits and entitlements by the Nominal Insurer.

Nominal Insurer claims operating structure

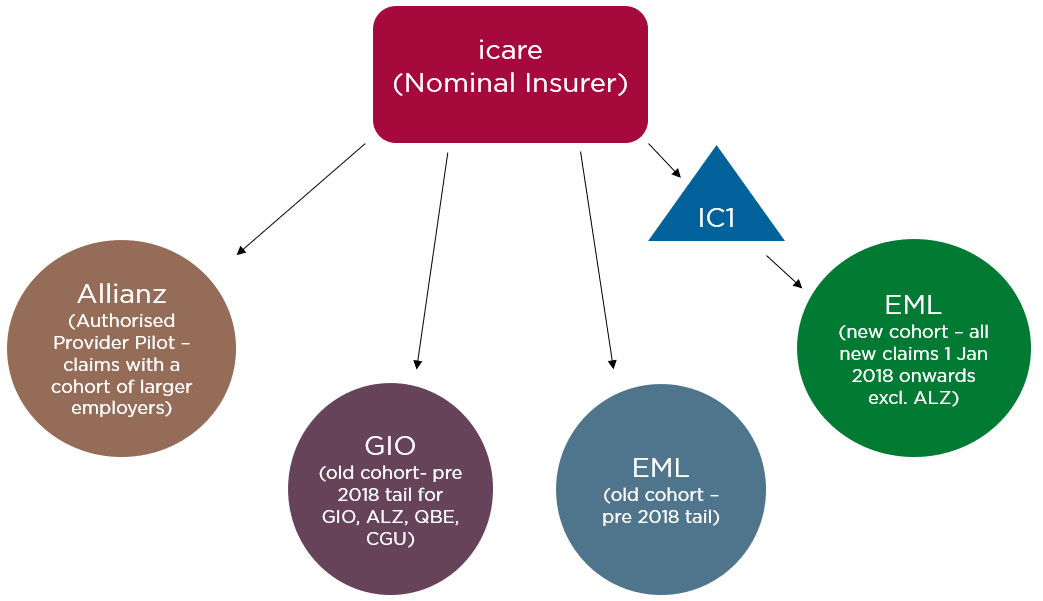

In April 2017, icare announced changes to the Nominal Insurer’s scheme agent and service provider claims service arrangements. Following a tendering process, icare selected EML, GIO and Allianz as partners (scheme agents) to provide claims services to the Nominal Insurer with CGU and QBE not continuing as service providers7.

EML was selected to be sole agent for all new claims from 1 January 2018 with GIO and Allianz continuing to provide claims services as transition agents. Both CGU and QBE concluded their role as an icare scheme agent on 31 December 2017.

In August 2018, it was announced that Allianz would continue to be contracted to provide additional claims services for larger employers under an authorised provider pilot.

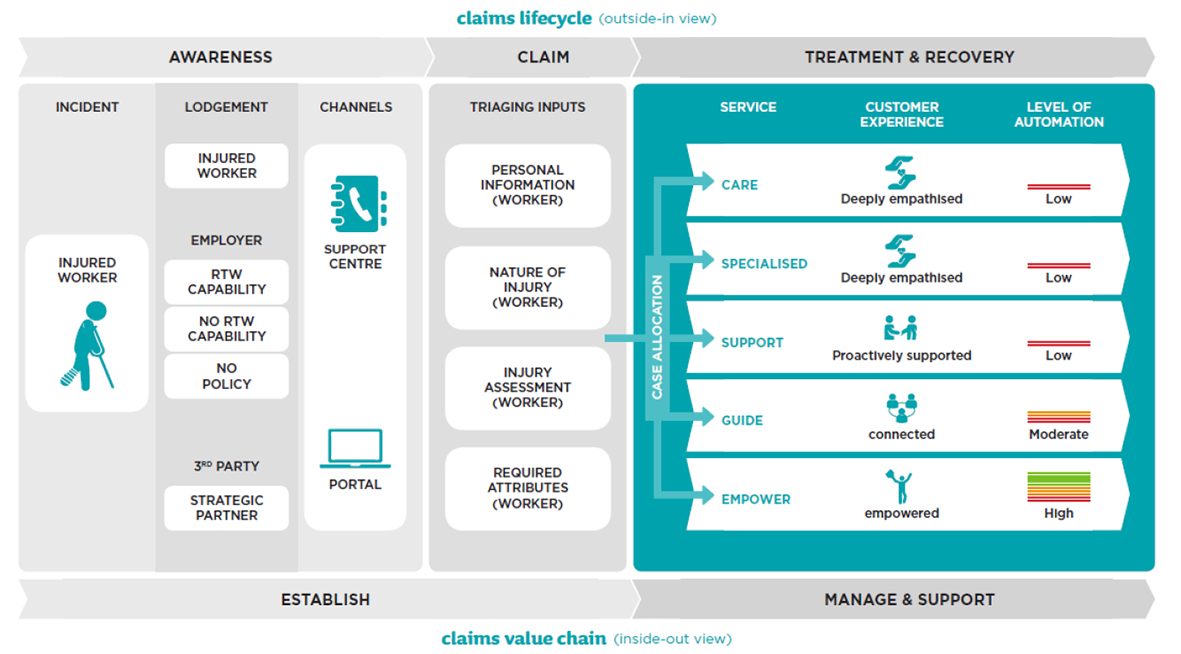

In 2018, icare introduced a new claims operating model8. EML implemented the new model on 1 January 2018 for all new claims received, while Allianz implemented the same claims operation model from June 2018.

Figure 3: Nominal Insurer claims service arrangements

Figure 4: Nominal Insurer claims operational model

Claims management questions

2.1 Please rate your experience with the management of claims by the Nominal Insurer (icare) and/or its scheme agents EML, Allianz and GIO from 5 (excellent) to 1 (poor).

2.2 What has been your experience with the management of claims by the Nominal Insurer (icare) and/or its scheme agents EML, Allianz and GIO?

2.3 From your perspective, what impact has icare’s new claims management processes had on return to work outcomes and the customer experience?

2.4 What should the Nominal Insurer (icare) and/or its scheme agents EML, Allianz and GIO be doing more of?

2.5 What should the Nominal Insurer (icare) and/or its scheme agents EML, Allianz and GIO be doing less of?

2.6 Are there any improvements you would like to suggest regarding claims management?

Other questions

Aside from your experience and views on premiums and claims management by the Nominal Insurer (icare), the scope also includes a review of changes to the Nominal Insurer’s operating model, its data quality and reporting. We are interested in any other matters you may want to raise.

3.1 Are there other matters or areas you like to comment on?

3.2 Are there any improvements you would like to suggest in these areas?

3.3 Do you have any other issues or ideas about the Nominal Insurer (icare) that you want to share?

Next steps

SIRA will acknowledge and review all submissions received. Information provided to SIRA through this public consultation process will be considered and used by both the Independent Reviewer and Independent Actuaries for their reports.

SIRA will receive regular progress reports and will reserve the right and responsibility to investigate and take action on any evidence of potential non-compliance with regulatory requirements identified by the public consultation and the Review, in advance of the final report.

Please email any questions or enquiries regarding this discussion paper to [email protected]

Notes

- June 2018 Workers compensation system monthly dashboard: Percentage share of premium paid FY 2016/2017

- June 2018 Workers compensation system monthly dashboard: Percentage share of total active claims FY 2017/2018

- State Insurance and Care Governance Bill 2015 second reading speech

- NSW workers compensation system – Annual performance report 2016/17, SIRA

- Workers Compensation Amendment (Insurance Reform) Bill 2003, Second reading

- State Insurance and Care Governance Bill 2015, Second reading

- Insurancenews.com.au 22 August 2016

- Media release, icare 26 April 2017

- Claims lifecycle overview, icare